For tax advisory firms worldwide, onboarding new clients effectively is crucial for accurate tax planning and compliance. Whether you’re handling individual or business tax filings, asking the right questions ensures a smooth process and minimizes risks. This guide covers 20 key questions every tax and accounting service provider should ask, helping clients navigate the complexities of tax laws across different countries.

Personal and Business Information

1. What is your full name and contact information?

This basic yet essential question helps maintain accurate records, ensuring that all documentation and tax filings are linked to the correct person. Contact details are also vital for communication regarding tax matters, updates, and reminders.

2. What is your Tax Identification Number (TIN) or equivalent?

Each country assigns a unique tax identification number (e.g., SSN in the U.S., UTR in the U.K., PAN in India) to taxpayers. This number is necessary for filing tax returns, tracking tax history, and complying with legal requirements.

3. What is the nature of your income or business?

Understanding whether a client earns through employment, business, investments, or property rentals helps determine the applicable tax brackets and deductions. Each income type has different tax implications that must be carefully managed.

4. Do you have multiple sources of income?

Many individuals and businesses have diverse income streams, such as salaries, dividends, rental income, or freelance work. Tax obligations vary based on the income source, and accurate reporting is crucial to avoid penalties.

Tax Compliance History

5. Have you filed tax returns before?

Reviewing past tax filings helps assess a client’s tax history, compliance status, and any issues that need addressing. It also helps tax advisors identify opportunities for deductions or amendments to optimize tax liability.

6. Do you have any pending tax assessments or audits?

If a client has been audited or assessed by tax authorities in the past, resolving outstanding matters is critical before proceeding with new filings. This prevents complications and potential legal repercussions.

7. Are there any unresolved tax disputes?

Ongoing disputes with tax authorities can affect new filings. Identifying and addressing these disputes early ensures smooth tax planning and compliance.

8. Do you have any pending tax dues or refunds?

Knowing whether a client has outstanding tax liabilities or pending refunds helps in financial planning. If tax dues exist, a strategy to clear them without incurring penalties should be developed.

Income and Expenses

9. What are your primary income sources?

Understanding a client’s income sources—such as salary, business profits, investments, and rental income—helps in determining the correct tax treatment for each type and ensures compliance with applicable tax laws.

10. Do you have major deductible expenses?

Tax-deductible expenses can significantly lower taxable income. These may include mortgage interest, medical expenses, business expenses, education costs, and charitable contributions.

11. Are you claiming business-related deductions?

Business owners and freelancers can claim deductions for office rent, travel expenses, software, equipment, and depreciation. Proper documentation of these expenses is necessary for tax filing.

12. Have you made any high-value transactions?

Large financial transactions, such as buying a property, investing in businesses, or purchasing high-value assets, may be subject to additional tax reporting requirements. Clients should disclose such transactions to ensure compliance.

Investments and Tax Planning

13. What tax-saving investments do you have?

Many countries offer tax-saving investment options, such as retirement plans (401(k), IRA, NPS), life insurance, health savings accounts, and government bonds. Proper tax planning can help maximize benefits from these investments.

14. Do you own foreign assets or investments?

Clients with foreign investments, bank accounts, or real estate may be subject to additional reporting requirements and tax obligations. Failure to report foreign assets can lead to penalties in some jurisdictions.

15. Have you invested in stocks, mutual funds, or cryptocurrencies?

Investment gains are typically subject to capital gains tax, which varies by country. Holding periods and asset types influence tax rates, making proper reporting and planning essential.

16. Do you earn rental income?

Rental income is taxable in most countries, but property owners can often deduct maintenance costs, mortgage interest, and depreciation. Proper record-keeping helps maximize deductions.

Business-Specific Questions

17. Do you maintain proper financial records?

Accurate bookkeeping is essential for businesses to track revenue, expenses, and profits. It also ensures compliance with tax laws and prepares businesses for potential audits.

18. Are you aware of tax benefits available in your country?

Many governments provide tax benefits for specific industries, startups, and businesses that invest in sustainability or innovation. Knowing and utilizing these benefits can help businesses reduce tax burdens.

19. How do you handle payroll taxes for employees?

Businesses with employees must withhold and remit payroll taxes, including income tax, social security contributions, and healthcare levies. Understanding these obligations prevents compliance issues.

20. Would you consider ongoing tax advisory services?

Continuous tax planning helps individuals and businesses stay compliant, reduce liabilities, and make informed financial decisions. Regular consultations with an expert in audit tax advisory services ensure tax strategies remain optimized.

Client Onboarding Process for Tax Advisory Firms

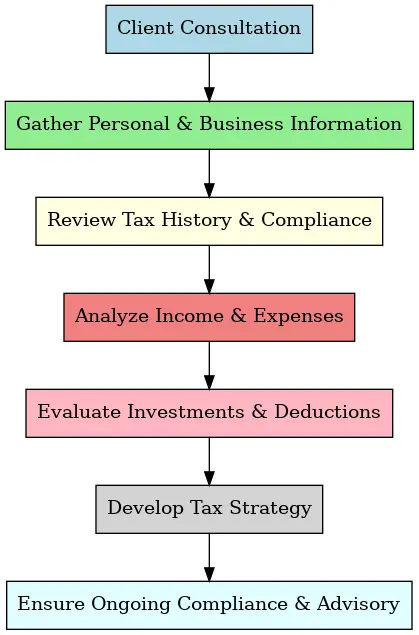

A structured onboarding process ensures smooth tax planning and compliance. Tax advisory firms must systematically collect and analyze client information to provide the best financial strategies. Below is a step-by-step process that tax professionals follow when onboarding new clients:

1. Client Consultation

The process begins with an initial consultation where tax advisors understand the client’s needs, financial background, and tax concerns.

2. Gather Personal & Business Information

Collecting essential details like name, contact information, tax identification number (TIN), and business type helps in accurate tax filing.

3. Review Tax History & Compliance

Analyzing past tax returns, audits, and pending tax dues allows advisors to identify compliance gaps and opportunities for deductions.

4. Analyze Income & Expenses

Understanding the client’s primary income sources, major expenses, and deductible transactions ensures better tax planning.

5. Evaluate Investments & Deductions

Assessing tax-saving investments, foreign assets, and high-value transactions helps optimize tax liability.

6. Develop Tax Strategy

Based on the gathered data, tax professionals create a personalized tax plan that maximizes savings and ensures compliance.

7. Ensure Ongoing Compliance & Advisory

Regular tax consultations help clients stay updated with tax regulations and make informed financial decisions.

Below is a flowchart that illustrates the entire tax client onboarding process:

By following this structured approach, tax advisory firms can streamline onboarding, minimize compliance risks, and provide effective financial planning for clients.

Conclusion

Tax advisory firms in India and worldwide can use these questions to streamline client onboarding, ensure compliance, and provide better tax optimization strategies. Whether serving individuals or businesses, a well-structured onboarding process enhances accuracy and builds trust with clients.

FAQs

Q1. How do you onboard a new client?

Onboarding a new client involves gathering essential information, reviewing their tax history, assessing their financial records, and identifying potential tax-saving opportunities. Tax advisory firms in India and worldwide follow a structured process that includes an initial consultation, document collection, compliance checks, and setting up a tax strategy. Providing clear guidance on tax obligations, deadlines, and available deductions ensures a smooth and efficient onboarding experience.

Q2. How do you build tax clients?

Building tax clients involves networking, providing excellent service, and establishing trust. Tax advisory firms in India and globally attract clients through referrals, online marketing, and thought leadership in audit tax advisory services. Offering personalized solutions, staying updated on tax laws, and maintaining strong client relationships help retain existing clients and attract new ones.