If you compare how things worked a few years ago to what’s happening in 2025, it’s pretty clear that audit and accounting services don’t operate the same way anymore.

The shift wasn’t sudden, but the traditional, slow methods just couldn’t keep up with what businesses need today. With new tools coming in, companies working across different markets, and everyone trying to stay ahead, the process has naturally evolved. Things are quicker, more practical, and definitely more streamlined than before.

Now, businesses expect accuracy, transparency, and financial support that actually helps them make smarter decisions. The old paperwork-heavy style has taken a backseat, and a more modern, efficient approach has taken over.

Below are the five most important ways these services are evolving this year.

How Technology Is Changing Accounting

Technology is now at the heart of modern accounting. From cloud platforms to automated bookkeeping software, businesses are shifting away from manual work and moving toward smart digital systems.

Here’s how tech is reshaping accounting in 2025:

- Real-time financial tracking

- Automation of repetitive tasks

- Instant invoice generation

- Faster data verification

- Quick access to historical reports

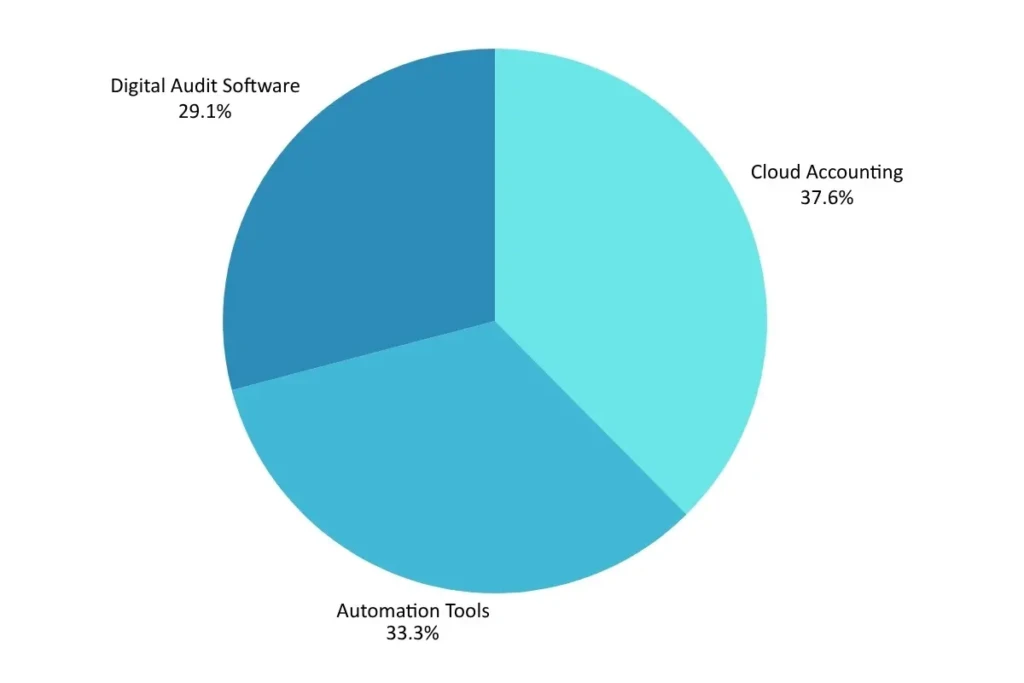

Adoption of Digital Tools in 2025

This digital shift helps companies save time, minimise errors, and make faster decisions.

Can AI Really Make Audits Smarter?

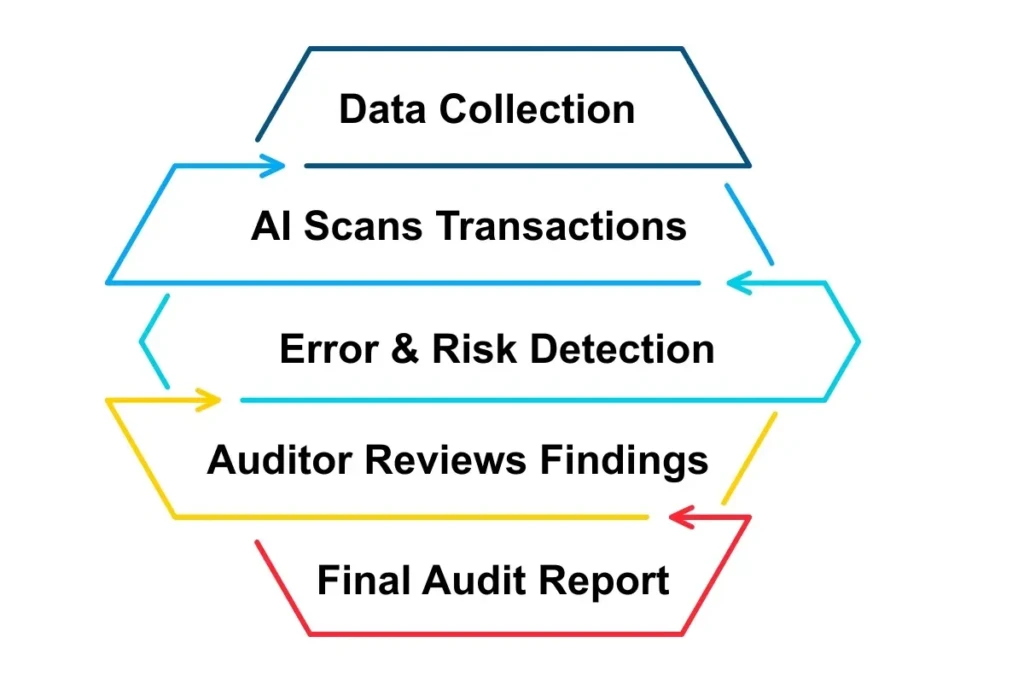

Artificial Intelligence is creating a massive change in how auditing services operate. Instead of checking files manually, AI systems scan thousands of entries in seconds and highlight risks instantly.

How AI supports modern auditing:

- Detects unusual transactions

- Flags errors automatically

- Predicts potential financial risks

- Gives auditors more time for analysis

- Improves overall audit accuracy

How AI-Assisted Audit Works

This makes audits smarter, faster, and far more reliable than traditional methods.

Is Cloud Accounting the Future of Finance?

Cloud-based solutions have become the backbone of modern financial management. They allow teams to work from anywhere, share data instantly, and collaborate with auditors without delays.

Key Benefits of Cloud Accounting:

- Access data from any device

- Automatic backups for safety

- Real-time financial updates

- Better communication with accounting teams

- Lower operational costs

Many businesses also use cloud platforms to streamline audit tax advisory services and keep all financial data organised in one place.

Why Are Advisory Services Important for Growth?

Today, audit and accounting are not just about checking numbers — they are about guiding businesses. Companies now look for audit tax advisory services that help them understand risks, improve operations, and make smarter decisions for long-term growth.

What modern advisory services include:

- Financial planning

- Tax management

- Compliance support

- Risk analysis

- Investment guidance

Traditional Services vs. Modern Advisory

| Earlier Approach | Modern Advisory Approach |

| Focused only on compliance | Offers real-time financial guidance |

| Static reports | Data-driven decision-making insights |

| Limited strategic support | Full business growth support |

Advisory services now play a major role in helping companies plan their next move and stay competitive.

Going Global: The Rise of Offshore Audit Partnerships

Businesses are expanding internationally, and many want financial support that is quick, cost-effective, and globally compliant. That’s why offshore auditing teams are becoming more popular.

Why companies prefer offshore audit partnerships:

- Lower costs

- Faster reporting

- Support from skilled specialists

- Compliance with global standards

- Access to advanced tools and resources

This shift has helped even small and medium businesses work more efficiently and confidently.

Final Thoughts

The way businesses manage their finances is changing fast, and the evolution of audits in 2025 proves it. With smarter tools, AI-driven checks, cloud-based systems, and stronger advisory support, companies now expect more accuracy, more clarity, and more strategic value than ever before. As businesses continue to grow and operate across different markets, many are also turning to offshore audit services to gain better efficiency, global expertise, and cost-effective solutions.

In the end, companies that adapt to these new-age audit and accounting trends will stay more confident, more compliant, and better prepared for the future.

FAQs

Q1. What is the future of audit 2025?

The future of audit in 2025 is all about faster, tech-driven processes that deliver real-time insights instead of slow, traditional checks.

Q2. How is auditing evolving?

Auditing is evolving into a more digital, analytics-focused process that gives sharper, quicker, and more reliable insights than old manual methods.

Q3. How will audit change in the future?

Audit will shift toward smarter, tech-driven reviews that are faster, more transparent, and focused on real-time risk detection rather than just checking past records.