Bookkeeping is an essential part of running a business, yet many companies struggle to keep their financial records accurate and up to date. Without proper book keeping and accounting services, businesses can face cash flow issues, tax penalties, and compliance risks. Whether you’re a small business owner or managing a large enterprise, understanding why bookkeeping is challenging and how to fix these issues can help you run a more profitable and stress-free business.

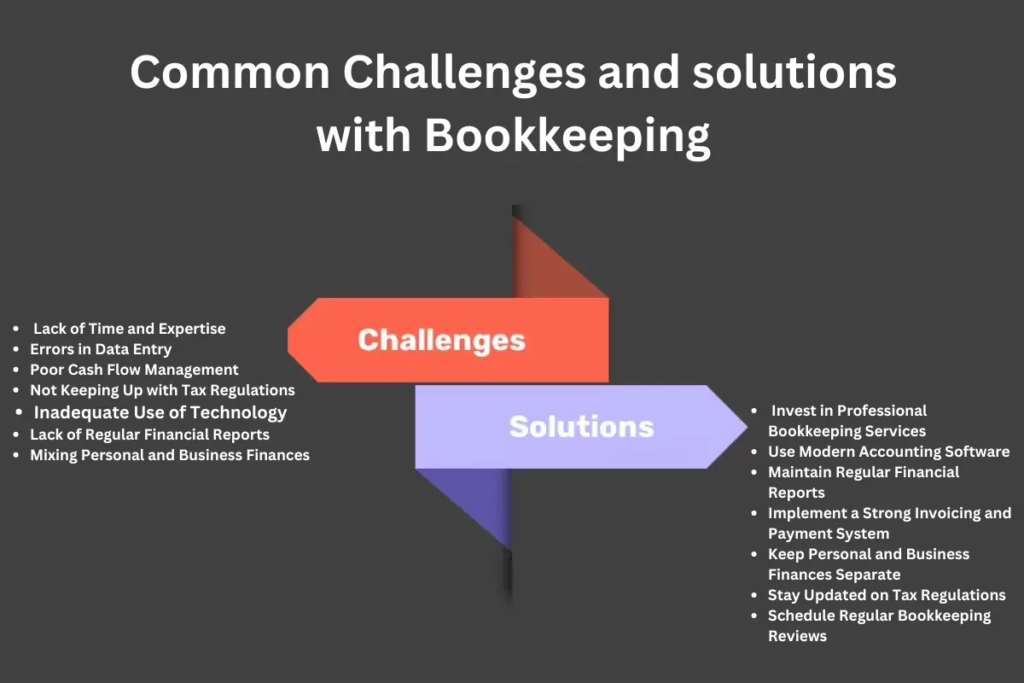

Common Challenges Businesses Face with Bookkeeping

1. Lack of Time and Expertise

Many business owners wear multiple hats, from sales and marketing to operations. Bookkeeping often takes a backseat, leading to inaccurate records and financial mismanagement. Hiring professional CPA and bookkeeping services can ensure financial accuracy and allow businesses to focus on growth.

2. Errors in Data Entry

Manual data entry increases the risk of mistakes such as duplicate entries, missed transactions, or incorrect categorization of expenses. These errors can distort financial statements and cause compliance issues.

3. Poor Cash Flow Management

Without proper accounting services in India or elsewhere, businesses may struggle to track income and expenses. Poor cash flow management can lead to overspending, missed payments, or a lack of funds for essential operations.

4. Not Keeping Up with Tax Regulations

Tax laws are complex and frequently change. Failing to comply with regulations can result in penalties, audits, or financial losses. Professional CPA and bookkeeping services ensure that businesses stay compliant and optimize tax deductions.

5. Inadequate Use of Technology

Many businesses still rely on outdated spreadsheets instead of modern accounting software. Without automation, bookkeeping becomes time-consuming and prone to errors.

6. Lack of Regular Financial Reports

Many businesses fail to generate profit and loss statements, balance sheets, or cash flow reports. Without these insights, it’s challenging to make informed financial decisions.

7. Mixing Personal and Business Finances

Small business owners often merge personal and business finances, leading to bookkeeping chaos. This makes tax filing complicated and can result in inaccurate financial reporting.

How to Fix Bookkeeping Challenges

1. Invest in Professional Bookkeeping Services

Outsourcing book keeping and accounting services to experienced professionals ensures accuracy, compliance, and efficiency. Companies specializing in accounting services in India offer cost-effective solutions tailored to business needs.

2. Use Modern Accounting Software

Switching to cloud-based software like QuickBooks, Xero, or FreshBooks can automate financial processes, reducing errors and saving time.

3. Maintain Regular Financial Reports

Generating monthly financial statements helps track profitability, monitor cash flow, and plan for future expenses. CPA and bookkeeping services can help businesses stay on top of their financial health.

4. Implement a Strong Invoicing and Payment System

Ensuring timely invoicing and payment collection can prevent cash flow shortages. Setting up automated payment reminders and clear payment policies is essential.

5. Keep Personal and Business Finances Separate

Opening a dedicated business bank account and using accounting software to track transactions separately helps maintain clarity in financial records.

6. Stay Updated on Tax Regulations

Working with a tax professional or outsourcing accounting services in India ensures businesses remain compliant with tax laws and take advantage of deductions.

7. Schedule Regular Bookkeeping Reviews

Setting aside time weekly or monthly to review financial records helps identify discrepancies and ensure all transactions are recorded accurately.

Conclusion

Bookkeeping challenges can hinder business growth, but they are entirely fixable with the right strategies. By leveraging professional book keeping and accounting services, investing in automation, and maintaining financial discipline, businesses can improve efficiency and profitability. If your business is struggling with bookkeeping, consider outsourcing to experienced CPA and bookkeeping services for hassle-free financial management.

Taking control of your bookkeeping today will lead to smoother operations and long-term business success.

FAQs

Q1. What is the biggest challenge as a bookkeeper?

The biggest challenge as a bookkeeper is maintaining accuracy while managing large volumes of financial data. Errors in data entry, misclassification of expenses, and reconciling discrepancies can lead to compliance issues.

Q2. What is one of the most common bookkeeping mistakes that business owners make?

For large businesses and corporations, one of the most common bookkeeping mistakes is poor cash flow management and lack of financial oversight. Many companies fail to regularly reconcile accounts, leading to discrepancies in financial statements.

Q3. What problem does a bookkeeper solve?

A bookkeeper ensures accurate financial record-keeping, helping businesses track income, expenses, and cash flow. They solve problems like data entry errors, tax compliance issues, and financial mismanagement.

Q4. How can bookkeeping be improved?

Bookkeeping can be improved by using modern accounting software, automating data entry, and maintaining regular financial reports. Large businesses can benefit from CPA and bookkeeping services to ensure accuracy and compliance. Outsourcing to professional book keeping and accounting services can also enhance efficiency and reduce errors.