In today’s regulatory environment, staying compliant isn’t just good practice it’s critical. Accounting and tax services are the backbone of a business’s financial health and reputation. Yet, many companies delay filings, mismanage compliance calendars, or rush submissions leading to penalties, audit risks, and operational roadblocks.

Whether you’re an early-stage startup in India, a growing company in the US or UK, or a multinational expanding across borders, timely accounting is your first defense against unnecessary financial stress.

Top Reasons Businesses Miss Tax Deadlines – and How to Avoid Them

Falling behind on tax filings is rarely intentional. Here are the most common reasons—and how to fix them:

Common Reasons:

- Lack of Internal Expertise: Many startups or small businesses don’t have a dedicated tax professional.

- Disorganized Books: Missing invoices or expense records lead to delays in closing books.

- Last-Minute Vendor Coordination: Waiting for vendors or partners to send invoices or data.

- Overwhelmed Teams: Finance teams juggling multiple roles often deprioritize tax filing tasks.

- Unfamiliarity with Changing Regulations: Frequent updates to tax rules (like India’s new TCS provisions or US R&D credit changes) catch businesses off guard.

How to Avoid:

- Automate Data Collection: Use accounting software that integrates with banks and invoicing systems.

- Schedule Regular Closings: Monthly or quarterly closing of books prevents end-of-year panic.

- Hire External Experts: Engage experienced professionals from accounting firms in India, the UK, or US to support your compliance.

- Stay Updated on Tax Laws: Subscribe to newsletters and official bulletins from tax authorities.

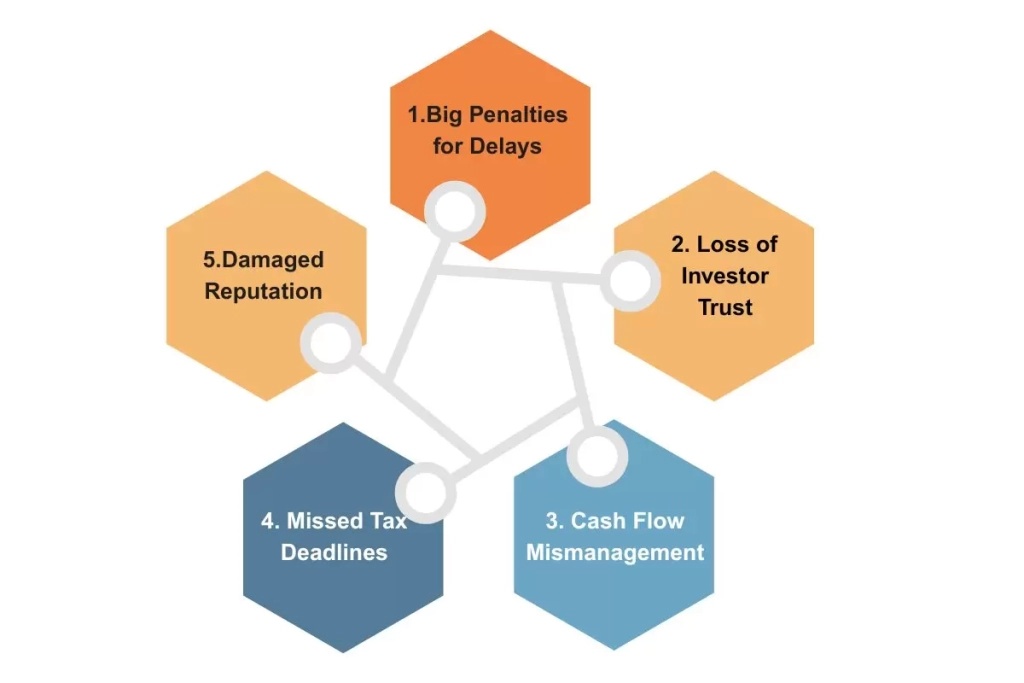

What Happens When Businesses Delay Their Financial Reporting?

1. Big Penalties for Delays

Late reporting can lead to high penalties from tax and regulatory bodies (like the IRS, HMRC, or the Indian Income Tax Department). These fines increase over time and damage your bottom line.

2. Loss of Investor Trust

Investors want transparency. If reports are late or inaccurate, it raises doubts and may lead to lost funding or broken partnerships.

3. Cash Flow Mismanagement

Without updated financials, it’s tough to track income vs. expenses. You might overspend or underpay taxes creating more problems down the line.

4. Missed Tax Deadlines

Late reporting often results in missing tax filing deadlines, which again brings penalties, interest, and compliance headaches.

5. Damaged Reputation

Vendors, lenders, or clients might see poor reporting as a sign of bad management which affects trust and your brand image.

Why Filing Taxes at the Last Minute Can Get You Audited

Filing your taxes too late or in a hurry can increase your chances of getting audited by tax authorities.

What Can Raise Red Flags:

- Guesswork in Numbers: Using rough or rounded figures looks suspicious.

- Missing Info: Skipping forms or details, especially for international dealings.

- Too Many Changes: Making corrections again and again makes your return look unreliable.

- Big Changes in Profit or Expenses: If your numbers suddenly change a lot, tax officers may want to know why.

Risk in Different Countries:

- India: Late or incorrect GST, TDS, or income tax returns may invite a closer look.

- USA, UK, Canada: If your income reports don’t match official slips like 1099s or T4s, you could face an audit.

Tip to Stay Safe:

Start your tax work at least 2–3 months before the deadline to avoid mistakes and reduce audit risk.

When to Hire an Accounting Partner to Avoid Deadline Stress

Timely compliance is a full-time task and not every business can (or should) manage it in-house. A professional partner can bring scalability, expertise, and peace of mind.

Signs You Need an Accounting Partner:

- You’ve missed deadlines or paid penalties before.

- Your finance team is overburdened or under-trained.

- You’re expanding to new geographies.

- You plan to raise funding or go through due diligence soon.

- You’re unsure about upcoming compliance changes.

Benefits of a Professional Accounting Partner:

- Expertise Across Jurisdictions: Especially helpful for cross-border operations.

- Deadline & Calendar Management: Never miss key dates again.

- Tax Planning & Forecasting: Reduce tax liabilities proactively.

- Audit Readiness: Clean, consistent records that stand up to scrutiny.

- Access to Tools: Benefit from industry-grade software and workflow systems.

Outsourcing to expert accounting firms in India or globally gives your business the flexibility to focus on growth while ensuring your financials are always in check.

Conclusion: Timely Accounting Is a Growth Strategy—Not a Compliance Burden

Non-compliance is expensive. Penalties, audits, missed opportunities, and reputational damage all come from avoidable delays in reporting or tax filing. With proper planning, expert guidance, and consistent financial processes, your business can move from reactive to proactive.

For startups and growing businesses across India, the US, UK, and Canada, investing in dependable accounting firm services isn’t just a smart financial decision it’s a long-term strategic one.

FAQs

Q1. How does accounting relate to taxes?

Accounting helps track income, expenses, and profits, which form the base for calculating taxes. Accurate accounting ensures correct tax filing and helps avoid penalties.

Q2. Do all accountants deal with taxes?

No, not all accountants handle taxes. Some focus on areas like bookkeeping, auditing, or financial analysis, while tax accountants specialize in preparing and filing tax returns.

Q3. Who files taxes?

Taxes are usually filed by individuals, businesses, or organizations that earn income. They can file taxes themselves or hire tax professionals or accountants to do it accurately.