In 2025, accounting for small business is no longer just about balancing books or filing taxes once a year. It has become the very foundation of smart decision-making, growth planning, and financial stability. For small business owners, proper accounting is like having a compass, it guides the business through unpredictable markets, new regulations, and growth challenges.

Small businesses that adopt modern accounting practices today are better equipped to scale, manage risks, and build trust with investors and customers alike. On the other hand, those who ignore it often find themselves struggling with cash flow shortages, compliance issues, and missed opportunities.

This blog uncovers the real truths behind accounting for small business in 2025—what truly drives success, where owners still go wrong, and how the right financial approach can fuel lasting growth

Why Smart Accounting for Small Business Will Define Success in 2025

The way small businesses manage their finances has changed drastically in the last decade. In 2025, “smart accounting” is not just a buzzword—it’s a business essential.

Why Smart Accounting Matters

- Real-Time Insights: Cloud-based platforms allow entrepreneurs to see their financial health instantly. Instead of waiting for month-end reports, they can track expenses and revenue daily.

- Accurate Decision-Making: With accurate numbers at hand, founders can decide whether to expand, hire, or cut costs.

- Efficiency through Automation: AI tools reduce manual work, minimize human errors, and speed up reconciliation.

Emerging Accounting Trends for Small Businesses in 2025

- AI-Powered Forecasting: Predicting cash flow trends before they happen.

- Integration with Banking Apps: Seamless connections between accounting software and banks.

- Mobile-First Accounting: Business owners managing accounts directly from their phones.

- Sustainability Accounting: Tracking environmental impact as part of financial decisions.

How Smart Accounting Drives Growth

Smart accounting gives small businesses a competitive edge by turning raw numbers into actionable insights.

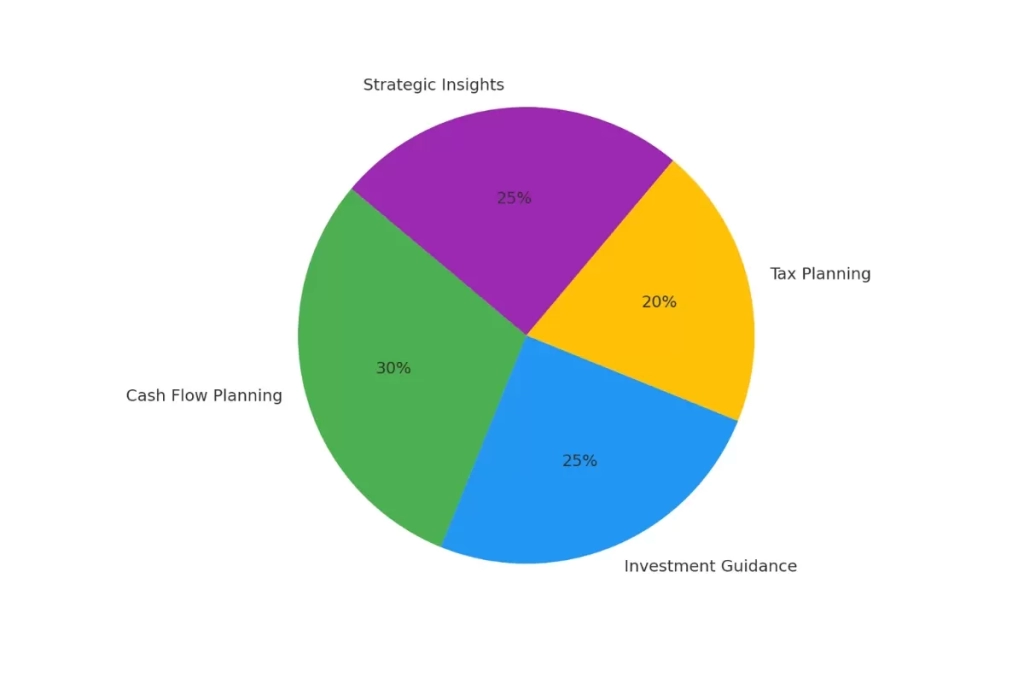

The Role of Accounting Financial Advisory in Growth Decisions

While accounting keeps the books in order, accounting financial advisory takes businesses to the next level by guiding owners on long-term strategy.

Why Advisory Matters

- Cash Flow Planning

- Involves forecasting the timing of money entering and leaving the business.

- Helps maintain sufficient liquidity to cover operational expenses and obligations.

- Prevents cash shortages and ensures smoother financial management during varying business cycles.

- Involves forecasting the timing of money entering and leaving the business.

- Investment Guidance

- Focuses on evaluating financial data and market conditions before making major spending decisions.

- Ensures investments in areas like expansion, staffing, or equipment align with long-term goals.

- Protects businesses from overspending and supports sustainable, profitable growth.

- Focuses on evaluating financial data and market conditions before making major spending decisions.

- Risk Management

- Identifies financial and operational risks that may affect stability.

- Reviews debt exposure, revenue patterns, and external market factors.

- Enables businesses to design strategies that minimize potential losses and strengthen resilience.

- Identifies financial and operational risks that may affect stability.

- Tax Optimization

- Centers on structuring finances to reduce tax liabilities while staying compliant with regulations.

- Utilizes deductions, credits, and exemptions applicable to the business.

- Frees up resources that can be reinvested into growth initiatives and future planning.

- Centers on structuring finances to reduce tax liabilities while staying compliant with regulations.

Book Keeping and Accounting Services That Actually Support Founders, Not Confuse Them

For years, small business owners have struggled with traditional bookkeeping. Reports were delayed, invoices piled up, and tax filing felt like a nightmare. Thankfully, 2025 is different.

How Modern Services Support Founders

- Automated Invoicing

Modern bookkeeping tools automate invoicing by generating bills and sending reminders without manual effort. This reduces errors, ensures timely payments, and helps maintain steady cash flow. Founders save time and avoid the stress of tracking overdue client accounts. - Dashboard Reporting

Instead of waiting weeks for financial updates, dashboards provide real-time summaries of income, expenses, and overall financial health. This gives founders a clear picture instantly, allowing them to make faster and smarter business decisions. - Cloud Storage

Storing records on the cloud means financial data is secure, accessible from anywhere, and safe from accidental loss. This allows founders to retrieve and share information easily, whether they’re in the office or on the go. - Scalability

As a business grows, its financial needs become more complex. Modern services scale up smoothly, adding new features and support without overwhelming the founder. This ensures that accounting systems remain efficient at every stage of business growth.

Common Accounting Mistakes Small Business Owners Still Make in 2025

Despite all the modern tools available, many small business owners continue to repeat the same mistakes in 2025. These mistakes not only cost money but can also damage credibility with investors and regulators.

The Top Mistakes in 2025

- Ignoring Cash Flow: Many owners focus on sales and revenue but forget to monitor actual cash flow. Without enough liquidity, even profitable businesses struggle to pay expenses on time.

- Mixing Personal & Business Accounts: Combining both accounts creates confusion in tracking expenses. It also raises red flags during audits and can lead to unnecessary tax complications.

- Overlooking Tax Deductions: Small businesses often miss eligible deductions and credits. This oversight means losing potential savings that could strengthen business finances.

- Delayed Financial Reporting: Late or irregular reporting hides financial problems until they become serious. Regular reports ensure issues are spotted early and addressed quickly.

- Avoiding Automation: Sticking to manual accounting increases errors and wastes valuable time. Automation makes processes faster, more accurate, and founder-friendly.

Conclusion

As 2025 unfolds, one truth becomes clear—accounting for small business is no longer just about balancing books, it’s about building a roadmap for growth. From avoiding common mistakes to leveraging financial advisory insights, the way small businesses manage their numbers will directly shape their success.

The businesses that thrive will be the ones that treat accounting as a strategic partner, not just a back-office task. Choosing the right book keeping and accounting services can make all the difference, ensuring that every financial move supports clarity, growth, and long-term stability.

In simple words, getting your accounting right in 2025 isn’t optional it’s the smartest investment a small business owner can make.

FAQs

Q1. What accounting is required for a small business?

A small business needs basic accounting like bookkeeping, tax preparation, financial reporting, and cash flow management. These ensure compliance, track profits, and help owners make smarter financial decisions.

Q2. How to record income and expenses for a small business?

Small businesses can record income and expenses through bookkeeping software or a simple accounting system that tracks sales, invoices, bills, and receipts. Keeping records updated regularly helps maintain accurate financial statements and ensures smooth tax filing.

Q3. What type of accountant is best for a small business?

A small business benefits most from a CPA or a business accountant who specializes in book keeping and accounting services. They not only handle taxes and compliance but also provide guidance on budgeting, cash flow, and long-term financial planning.