When building a business, financial strategy often decides whether you thrive or just survive. Many entrepreneurs realize too late that hiring the best virtual CFO services could have saved them from costly mistakes, inefficient processes, and missed opportunities. Virtual CFOs are no longer just for large corporations; they’ve become a game-changer for startups and scaling businesses too.

In this blog, we’ll explore what founders wish they knew before hiring a Virtual CFO covering underestimated roles, hidden costs, real service scope, unexpected tech gaps, and decision-making transformations.

What “Best Virtual CFO Services” Actually Cover

Many founders hire without fully understanding what a Virtual CFO provides. Contrary to belief, the best virtual CFO services extend far beyond bookkeeping.

Key Functions of a Virtual CFO:

- Strategic Financial Planning – Long-term growth roadmaps.

- Investor Readiness – Designing pitch decks with strong numbers.

- Performance Tracking – Setting KPIs and dashboards.

- Tax Strategy & Compliance – Reducing liabilities, ensuring accuracy.

- Risk Management – Identifying and mitigating financial risks.

For startups, especially those seeking scale, the role of CFO becomes crucial. This is where many founders now rely on virtual CFO services in Gurgaon, a hub for fast-growing companies in India, where experienced CFO professionals bring both local expertise and global compliance knowledge.

In-House CFO vs Virtual CFO Services

| Aspect | In-House CFO | Virtual CFO Services |

| Cost | High salary + benefits | Affordable monthly plans |

| Availability | One person | Team of experts |

| Scalability | Limited | Flexible, as per growth |

| Global Expertise | Often limited | Cross-border knowledge |

Why Founders Underestimate the Role of a Virtual CFO

Most founders start their journey relying on accountants or bookkeepers, assuming that’s enough. What they don’t realize is that a Virtual CFO isn’t just about balancing books—it’s about guiding financial strategy, unlocking growth, and ensuring sustainability.

Common Founder Misconceptions:

- A CFO is only for large corporations.

- Accountants and CFOs do the same job.

- We can handle finance ourselves until we grow big.

The truth? A Virtual CFO provides strategic oversight:

- Aligns financial planning with business goals.

- Creates cash flow forecasts that prevent liquidity crises.

- Helps founders pitch better to investors with credible financial models.

Quote to Highlight:

“A CFO is not a luxury—it’s a necessity for survival in today’s competitive markets.” – Warren Buffett, Chairman of Berkshire Hathaway

The Hidden Costs of Delaying CFO Support

One of the most common mistakes founders make is postponing the decision to bring financial leadership into their business. At first, it seems logical: why hire a CFO when you’re still small, and budgets are tight? But what many entrepreneurs don’t realize is that the cost of waiting far outweighs the monthly fees of hiring a Virtual CFO early on.

Instead of protecting cash flow, delaying CFO support often leads to missed opportunities, financial blind spots, and unnecessary risks. Here’s how it impacts businesses:

1. Missed Funding Opportunities

Investors don’t just fund ideas they fund financial clarity. Without a CFO, founders often rely on rough estimates or incomplete projections. This leaves investors unconvinced and leads to lost chances at securing capital.

- Poorly structured pitch decks fail to show realistic growth models.

- Lack of detailed forecasts makes valuations unreliable.

- Potential investors lose confidence in long-term planning.

A single missed investment round can set growth back by months, if not years.

2. Poor Cash Flow Management

Cash flow is the lifeblood of any business. Without strategic oversight, many founders only realize cash crunches when it’s too late.

- Revenue might look healthy, but expenses come faster than collections.

- Seasonal fluctuations remain unplanned, leading to sudden shortages.

- Emergency loans at high interest rates become the only way out.

A Virtual CFO ensures cash flow forecasting and planning, preventing businesses from running dry at critical moments.

3. Compliance Penalties and Legal Risks

Tax and regulatory compliance may seem straightforward, but as businesses scale, requirements become more complex. Without CFO oversight:

- Companies miss critical filing deadlines.

- Inaccurate tax planning leads to unnecessary penalties.

- Cross-border businesses face complex international compliance risks.

Instead of saving money, founders end up paying fines and scrambling for legal help, which a Virtual CFO could have prevented.

4. Inefficient Decision-Making

In the absence of a financial strategist, founders often make decisions based on gut instinct or limited data. While intuition is valuable, it can be dangerous when scaling.

- Choosing the wrong market for expansion.

- Investing heavily in low-ROI products.

- Hiring too quickly without financial sustainability.

Without a CFO’s guidance, expansion becomes guesswork, and mistakes become expensive lessons.

5. The Opportunity Cost of Lost Time

Perhaps the most overlooked cost is time. Every quarter without proper financial leadership is a quarter of missed growth opportunities. Competitors with CFO-backed strategies often outpace founder-led startups, leaving them playing catch-up.

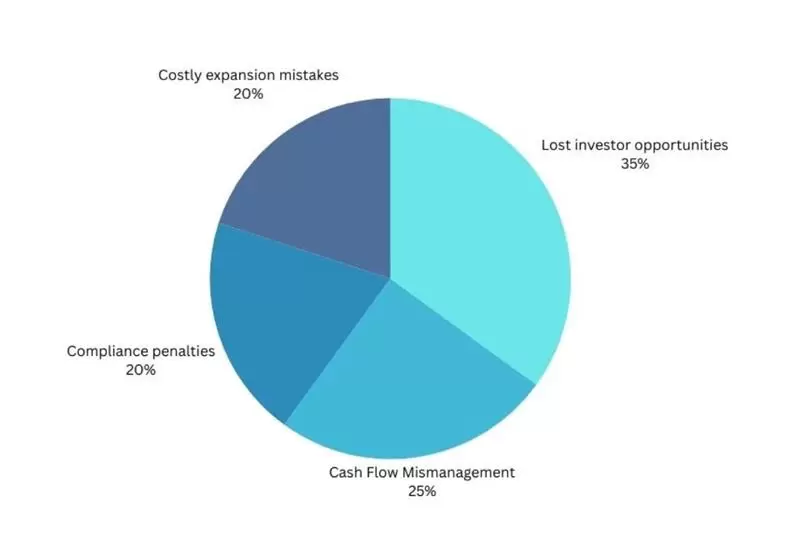

Impact of Delaying CFO Support

The Technology Gap Founders Don’t Expect

In today’s digital-first world, Virtual CFOs don’t just bring expertise they bring technology-driven solutions. Many founders realize too late that their outdated systems cannot handle advanced reporting or analytics. The best virtual CFO services introduce cloud-based platforms, AI-driven analytics, and real-time dashboards that completely transform financial management.

For a virtual CFO small business, this technology advantage is even more critical. Small businesses often operate with lean teams and limited bandwidth, so adopting modern financial tools helps them scale faster, stay compliant, and compete with larger enterprises.

How Virtual CFOs Bridge the Tech Gap:

- Automating routine processes like payroll & invoicing.

- Providing real-time visibility into cash flow.

- Offering integrations with CRM, ERP, and accounting tools.

- Enhancing decision-making with accurate, data-driven reports.

Conclusion: Lessons Every Founder Should Carry

Hiring a Virtual CFO isn’t just an expense, it’s an investment in sustainability, growth, and peace of mind. Founders who delay often regret it, while those who act early unlock smoother funding, smarter decisions, and stronger financial foundations.

If you’re looking to scale efficiently, avoid costly mistakes, and future-proof your business, partnering with experts is key. This is where virtual accounting firms in India step in, bringing global best practices and technology-driven insights at an affordable cost.

FAQs

Q1. What is a virtual CFO service?

A virtual CFO service gives businesses access to experienced financial leadership without hiring a full-time CFO. It covers strategic planning, cash flow management, compliance, and growth support—ideal for startups and small businesses seeking cost-effective expertise.

Q2. How much does a Vcfo cost?

The cost of a vCFO varies based on the scope of services, business size, and complexity, typically ranging from a few hundred to a few thousand dollars per month. It’s far more affordable than hiring a full-time CFO while still delivering high-level financial expertise.

Q3. Who is eligible for CFO?

Any business that needs strategic financial guidance—whether a startup, small business, or growing enterprise—can benefit from a CFO. Companies often seek a CFO when scaling, managing complex finances, or preparing for investment and compliance.