In 2025 and beyond, book keeping and accounting services are evolving faster than ever. New technologies, smarter tools, and changing client expectations are reshaping how businesses manage their finances. Whether you’re running a small business or overseeing a growing company, adapting to these changes is crucial for continued success and growth.

Let’s look into it what the future holds and how you can make the most of it.

Technology is Changing Everything

At DGA Global, we don’t just keep up with change — we drive it. Our book keeping and accounting services are powered by the latest cloud platforms, automation tools, and AI-based systems that make finance smarter and simpler for our clients.

What We Offer:

- Cloud Accounting – Access your data anytime, anywhere

- Automated Workflows – Faster invoicing, reconciliations, and reporting

- Real-Time Insights – Dashboards that help you make better decisions

- Accurate Compliance – Timely GST, TDS, and tax filings

Why Choose DGA Global?

- Save time and reduce errors

- Get complete financial visibility

- Scale effortlessly as your business grows

With DGA Global, technology works for you, not against you.

Accountants Are Becoming Business Advisors

Accounting today is much more than just recording transactions. Accountants are evolving into trusted business advisors who help owners make smarter financial decisions for growth and success.

How Accountants Add Value as Business Advisors:

- Cash Flow Planning:

Helps you manage when to spend, save, and ensure steady cash flow. - Budgeting & Forecasting:

Guides setting realistic financial goals and preparing for fluctuations. - Profitability Analysis:

Identifies your most profitable products, services, or customers. - Tax Strategy:

Provides advice to minimize tax liabilities proactively. - Business Health Checks:

Conducts regular financial reviews to spot potential issues early. - Growth Planning:

Supports decisions related to funding, expansion, and hiring.

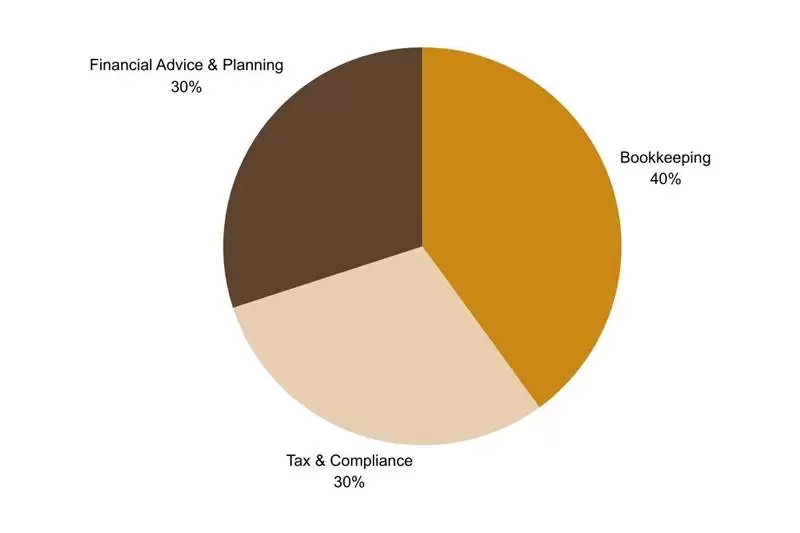

Accounting Services Breakdown

Why Small Businesses Need Smarter Accounting

In today’s fast-moving market, small businesses need more than just basic bookkeeping. They need real-time insights, proactive support, and smarter tools — and that’s exactly what DGA Global delivers.

a) More Than Just Data Entry

Accounting for small business today goes beyond just recording transactions. You need proper reports, compliance, and insights to grow.

DGA Global provides:

- Clean, accurate books

- Real-time dashboards

- Automated GST and TDS alerts

b) Stay on Top of Cash Flow

Most small businesses fail due to poor cash flow management — not lack of sales.

DGA Global helps:

- Track inflows/outflows

- Set spending limits

- Get alerts when cash runs low

c) Easy, Stress-Free Compliance

Forget last-minute tax panic. Our team ensures your filings are done right and on time.

We handle:

- GST, TDS, payroll compliance

- Input credit tracking

- Audit-ready documentation

d) Make Faster, Smarter Decisions

DGA Global gives you real-time access to financial data, so you don’t have to guess.

Get:

- Proper reports

- Visual performance dashboards

- Smart insights for planning

e) Scalable Services as You Grow

Our accounting services for a small business grow with you — from startup to scale-up.

Start with:

- Bookkeeping → Add payroll → CFO-level support

More Businesses Are Moving to the Cloud

Cloud accounting is no longer a trend it’s the standard. In 2025, most businesses, big or small, are switching to cloud-based platforms like QuickBooks, Zoho Books, and Xero.

These tools allow you to access your accounts from anywhere, collaborate with your accountant in real time, and make smarter decisions using live data.

Traditional Accounting vs Cloud Accounting

| Feature | Traditional Accounting | Cloud Accounting |

| Access | Only on office systems | Anytime, anywhere |

| Updates | Manual | Automatic & real-time |

| Collaboration | Limited | Multi-user collaboration |

| Data Security | Depends on local setup | Encrypted and backed up |

Benefits :

- Easy access from any device

- Real-time updates and backups

- Reduced IT costs and maintenance

- Better collaboration with finance teams or consultants

Final Thoughts

The future of accounting is digital, fast, and intelligent. Businesses especially small and growing ones can no longer afford to stick with old systems. From smarter tools to strategic advice, the transformation is already here.

If you’re looking to stay ahead, it’s time to rethink how you manage your finances and partner with experts who understand modern accounting firm services.

At DGA Global, we help businesses move beyond traditional accounting. With cloud-based tools, advisory support, and secure services, we’re ready for the future and ready to help you grow.

FAQs

Q1. What are bookkeeping and accounting services?

Bookkeeping and accounting services involve recording, organizing, and managing financial transactions to keep your business’s finances accurate and up to date. These services also include preparing financial reports and ensuring compliance with tax regulations.

Q2. Is bookkeeping considered an accounting service?

Yes, bookkeeping is a part of accounting services. It involves the day-to-day recording of financial transactions, while accounting includes a broader range of tasks like analyzing financial data, preparing reports, and advising on financial decisions.

Q3. What are the basic principles of bookkeeping?

The basic principles of bookkeeping include recording all financial transactions accurately, maintaining a clear and organized ledger, and ensuring that every debit has a corresponding credit to keep the accounts balanced.