Best virtual CFO services are revolutionizing the way businesses manage finances in the AI era. Every organization today aims to balance technology with financial intelligence, and Virtual CFOs are bridging human expertise with AI-driven insights. As Artificial Intelligence continues to redefine operations, these services are becoming essential for smarter, faster, and more strategic decision-making.

Benefits of AI-Driven Virtual CFO Services

When AI and Virtual CFO expertise come together, businesses gain efficiency, transparency, and foresight.

Key benefits include:

- Real-Time Financial Visibility: Get live dashboards and instant analytics.

- Cost Efficiency: Avoid full-time CFO expenses with outsourced expertise.

- Data Accuracy: Minimize manual errors with automation.

- Predictive Forecasting: Use AI-driven insights for long-term planning.

- Strategic Decision Support: Combine AI data with CFO experience.

The AI Revolution in Financial Management

The rise of Artificial Intelligence (AI) has transformed how businesses handle finance. From automating bookkeeping to enabling predictive analytics, AI has shifted finance teams from manual operations to smart, real-time decision-making.

Key ways AI is reshaping financial workflows include:

- Automated Bookkeeping: AI tools instantly categorize and reconcile transactions.

- Predictive Insights: AI models help businesses forecast cash flow and profits.

- Anomaly Detection: Systems detect unusual spending patterns early.

- Strategic Planning: AI provides data that fuels long-term financial planning.

This revolution enables CFOs to focus on strategy rather than spreadsheets a shift that has made Virtual CFOs indispensable for growing companies.

Why Businesses Prefer Virtual CFOs in the AI Era

Companies today seek flexibility, agility, and affordability. Hiring a full-time CFO can cost significantly, while a Virtual CFO brings the same strategic input at a fraction of that price. Many virtual accounting firms in India now offer these AI-powered CFO services, making it easier for businesses to access expert financial guidance without the full-time cost.

The AI element makes it even better ensuring smarter insights and quicker decisions.

For instance:

- AI predicts future market fluctuations.

- Virtual CFO interprets those results to create strategic responses.

Here’s a comparison of how a Virtual CFO combined with AI can outperform traditional CFO setups:

| Function | Traditional CFO | Virtual CFO + AI |

| Market Analysis | Manual & slower | AI-powered predictive insights |

| Risk Assessment | Periodic reviews | Real-time alerts & mitigation |

| Decision Making | Based on reports | Strategy-driven, AI-supported |

| Cost | High salary & benefits | Pay-as-you-go, affordable |

Together, this combination reduces financial risks, improves profitability, and creates a competitive advantage especially for growing companies that want to scale efficiently.

The Role of Virtual CFOs in the Modern AI Era

A Virtual CFO acts as your outsourced financial strategist — managing forecasting, compliance, and business planning without the cost of a full-time executive. But in the AI era, their role has become even more powerful.

Today’s Virtual CFOs leverage AI analytics tools to deliver faster and more accurate insights. They don’t just interpret numbers; they translate them into smart business decisions.

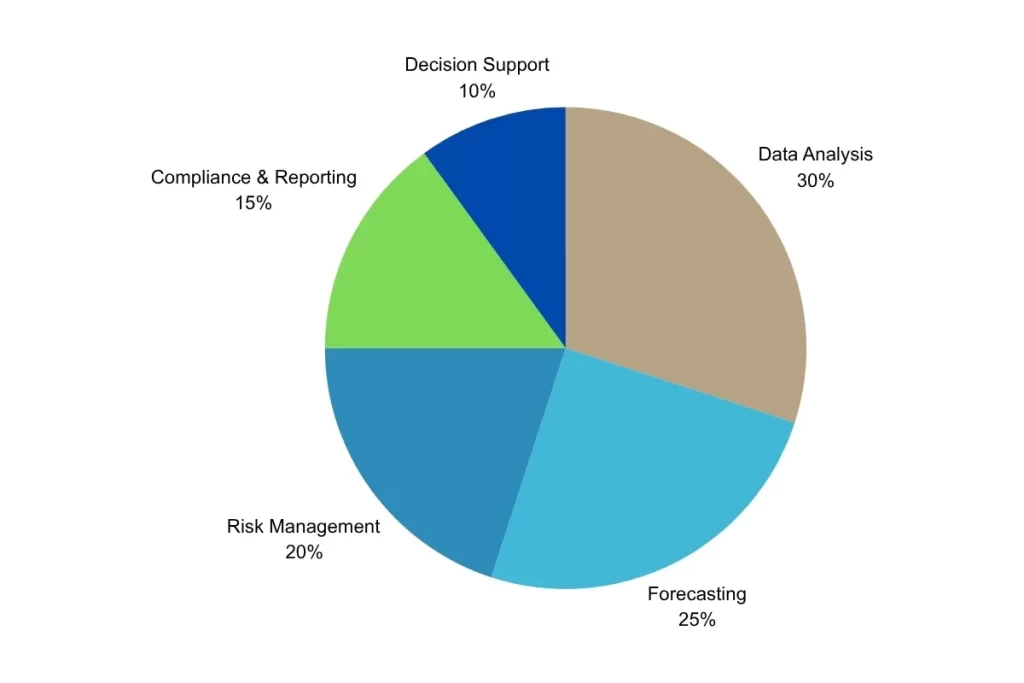

Core responsibilities of Virtual CFOs now include:

- Financial planning and analysis (FP&A)

- Cash flow and risk management

- Budget forecasting using AI tools

- Regulatory compliance and audit readiness

Virtual CFOs for Small Businesses: A Smart AI Partner

For startups and smaller companies, the blend of technology and expertise is a game-changer. A virtual CFO small business solution enables organizations to enjoy CFO-level insights without stretching budgets.

Advantages for small businesses include:

- Tailored financial planning powered by AI analytics

- Scalable services that evolve with company growth

- Access to top-tier financial strategy without full-time cost

- Instant financial visibility with AI-integrated dashboards

Small businesses now have access to the same strategic advantages that once only large corporations could afford.

Conclusion: Balancing AI Power with Human Expertise

While AI brings precision and automation, it’s the Virtual CFO’s human expertise that turns data into direction. The collaboration ensures every business decision is both analytically strong and strategically relevant.

By choosing a Virtual CFO, you’re not just outsourcing financial management you’re embracing innovation that keeps your business ahead of the curve. In a world driven by technology, smart businesses combine digital insights with human judgment to master accounting for small business success.

FAQs

Q1. Will CFOs be replaced by AI?

CFOs won’t be fully replaced by AI, as human judgment is key for strategy. At the same time, AI handles routine tasks and provides faster insights, making CFOs who use it more effective. The best results come when CFOs and AI work together.

Q2. Is AI technology used to create virtual financial advisors?

Yes, AI technology is used to create virtual financial advisors. These tools can analyze data, provide insights, and assist with budgeting or investment decisions. However, human oversight is still important to ensure personalized and accurate financial guidance.

Q3. What are the four roles of the CFO?

The four main roles of a CFO are financial planning, risk management, reporting and compliance, and strategic decision-making. They ensure the company’s finances are organized, risks are managed, reports are accurate, and business decisions are guided by strong financial insights.