In today’s fast-paced financial landscape, client advisory services are no longer limited to providing guidance on numbers; they’re about delivering insight, foresight, and smarter decisions. In 2025, technology has become the game-changer that transforms how advisors interact with clients, analyze data, and create value. From automation to artificial intelligence (AI), the digital wave has made advisory services more precise, efficient, and impactful than ever before.

The Rise of Digital Transformation in Client Advisory

Over the past decade, technology has reshaped every layer of financial advisory. Traditional processes once handled manually, are now automated, allowing advisors to spend less time crunching numbers and more time adding strategic value.

How technology drives this change:

- Automation tools simplify repetitive bookkeeping and reporting tasks.

- AI algorithms analyze data faster and with greater accuracy.

- Cloud-based systems ensure real-time collaboration between clients and advisors.

- Advanced analytics help advisors identify trends and make data-driven recommendations.

- Mobile and remote access platforms allow clients and advisors to interact anytime, anywhere.

These tools help firms like DGA Global streamline operations and deliver timely, actionable insights building stronger trust and long-term relationships with clients.

Smarter Decision-Making with Data Analytics

The power of advisory lies in data-driven decisions. In 2025, financial advisors rely heavily on analytics to decode client data, identify patterns, and forecast future trends. Leveraging advanced tools, firms providing cpa bookkeeping services to India can now deliver precise insights and actionable recommendations to their clients.

Role of Data Analytics in Client Advisory

| Analytics Tool | Function | Benefit |

| Predictive Analytics | Forecasting & Trend Analysis | Anticipate client needs and market shifts |

| Dashboards & Visualization | Data Interpretation | Easy-to-read insights for clients |

| AI-Driven Reports | Tailored Recommendations | Personalized financial advice |

| Real-Time Tracking | Performance Monitoring | Quick adjustments and proactive planning |

How Analytics Improve Advisory Efficiency

- Predictive Analytics – Helps advisors anticipate market shifts and client needs.

- Dashboards & Visualization Tools – Simplify complex data for easy interpretation.

- AI-Driven Reports – Offer tailored financial advice based on client behavior.

- Real-Time Performance Tracking – Allows advisors to monitor trends and respond proactively.

Benefits of Data-Driven Advisory

- Enhanced Accuracy – Reduces human errors and ensures reliable insights.

- Faster Decision-Making – Enables advisors to provide timely recommendations.

- Strategic Planning – Supports forecasting and long-term financial strategies.

Cloud Collaboration: Building Real-Time Client Connections

Gone are the days when clients waited weeks for financial reports. Thanks to cloud computing, collaboration between advisory firms and clients has become seamless, secure, and instant.

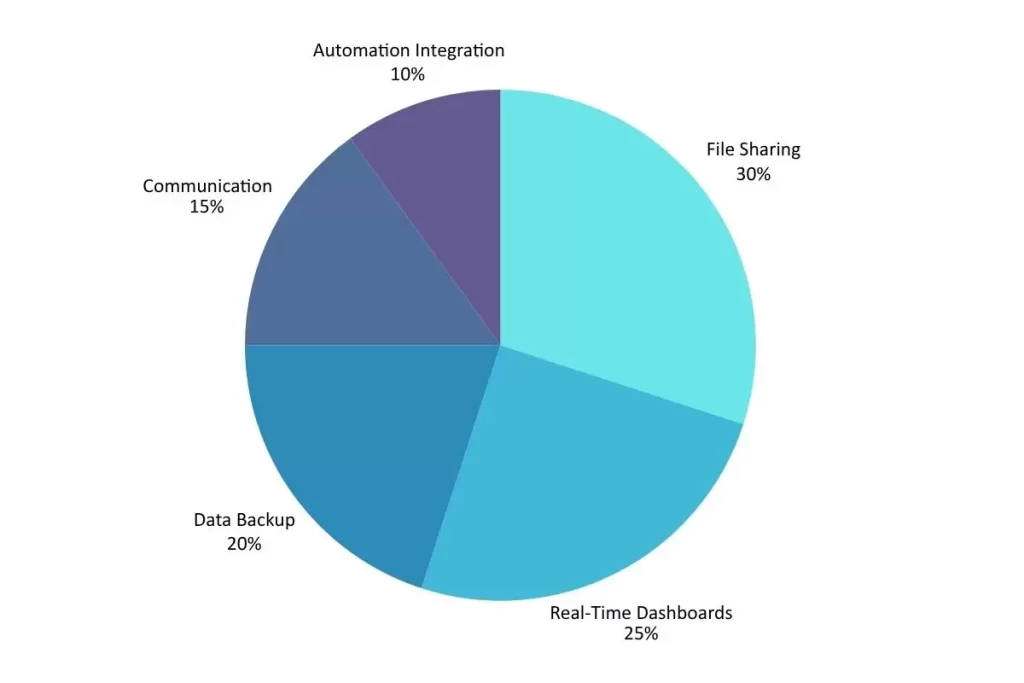

Usage of Cloud Tools in Advisory (2025)

Personalized Advisory Through Integrated Platforms

In 2025, personalization is the hallmark of great client advisory. Modern clients expect more than reports—they expect strategic partnership and customized insights that reflect their unique goals and challenges.

Key trends shaping personalized advisory:

- Integrated software ecosystems: Merging accounting, payroll, and CRM data for a 360° view.

- AI-based personalization: Tailoring advice based on spending patterns and financial goals.

- Collaborative dashboards: Allowing clients to interact directly with their financial data.

This evolution of advisory services in accounting not only improves efficiency but also enhances the overall client experience. Firms that embrace these integrated, personalized systems stand out as trusted advisors rather than just service providers.

Conclusion: Technology + Expertise = The Future of Advisory

As 2025 unfolds, technology continues to redefine what clients expect from advisory firms. Cloud platforms, AI tools, automation, and analytics are no longer optional—they’re essential to remain competitive and relevant.

For firms like DGA Global, this digital transformation means combining human insight with data intelligence to deliver smarter, faster, and more valuable financial guidance. It’s not about replacing human expertise but amplifying it through innovation.

So whether you’re seeking comprehensive advisory solutions, bookkeeping and tax service, or end-to-end financial management, technology is the bridge that connects today’s insights with tomorrow’s success.

FAQs

Q1. What are advisory clients?

Advisory clients are individuals or businesses who seek professional guidance from financial or accounting advisors to make informed decisions. They rely on experts for strategic planning, risk management, and financial insights. These clients benefit from tailored advice to achieve their business or personal financial goals.

Q2. What does CAS mean in audit?

CAS, or Client Accounting Services, sometimes referred to as Client Accounting Advisory Services (CAAS), involves managing and advising on a client’s accounting processes. It includes bookkeeping, financial reporting, and strategic guidance to ensure accuracy, compliance, and informed decision-making.

Q3. What is the role of a client advisor?

A client advisor provides expert guidance to individuals or businesses on financial, accounting, or strategic matters. They help clients make informed decisions, manage risks, and optimize resources. Their role is to offer personalized solutions that align with the client’s goals and objectives.