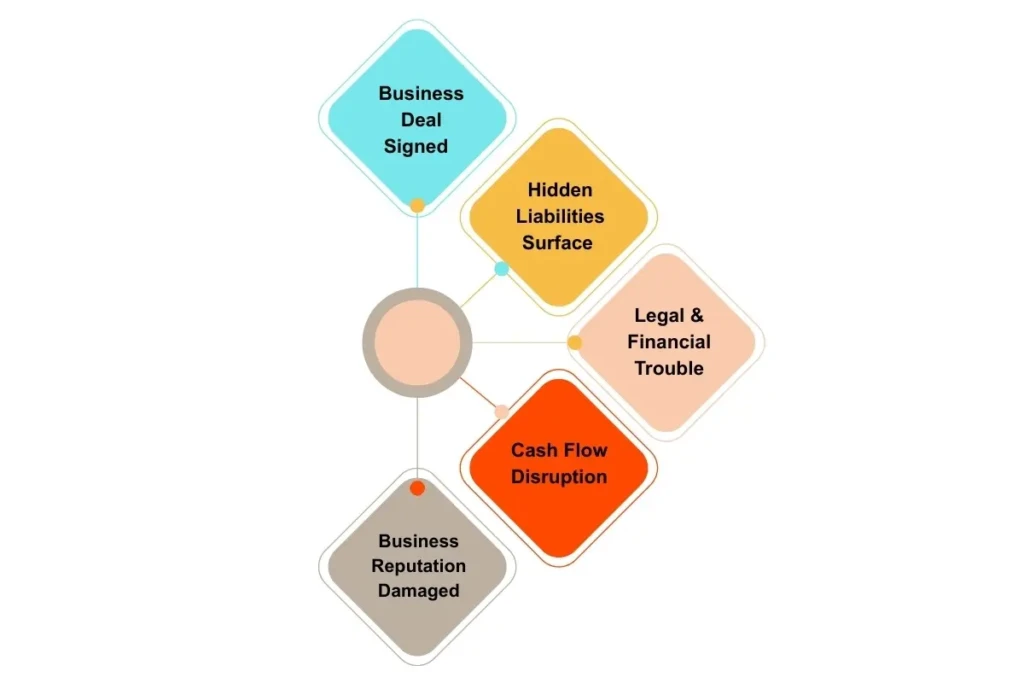

Financial due diligence is the backbone of any smart business decision yet many companies still skip it in the rush to close deals. But what really happens when you ignore this crucial step? The consequences can be far more damaging than most founders realize. From hidden debts to legal troubles and failed acquisitions, skipping financial due diligence can put your entire business at risk.

In this blog, we’ll explore the real impact of avoiding due diligence, backed by practical insights, simple explanations, and growth-focused strategies.

Hidden Financial Risks You Can’t See Coming

Skipping due diligence services is like buying a house without checking its foundation. Everything may look perfect on the surface, but the cracks appear later.

Common risks you may miss:

- Undisclosed liabilities

- Inflated revenue figures

- Fake customer contracts

- Pending lawsuits

- Tax penalties

Impact on your business:

- Sudden cash flow crisis

- Legal disputes

- Loss of investor trust

- Unexpected operational costs

For Example:

A startup acquires a company without reviewing its tax history. Later, they discover unpaid taxes worth ₹50 lakhs. Now they’re legally responsible.

Skipping this step doesn’t save time it creates long-term problems.

Why Deals Fail Without Proper Verification

Many business deals fail not because of bad intentions but because of bad information.

Key verification gaps when you skip checks:

- Fake financial statements

- Overvalued assets

- Undisclosed debts

- Poor internal controls

Table: Deal Outcomes Comparison

| With Due Diligence | Without Due Diligence |

| Verified numbers | False revenue data |

| Risk assessment | Surprise losses |

| Clear liabilities | Hidden debts |

| Informed decisions | Regretful decisions |

| Long-term success | Short-term gains |

Without proper verification, you are making decisions in the dark and that’s risky business.

Compliance & Tax Issues That Can Destroy Growth

Ignoring financial checks often leads to serious compliance failures. This is where due diligence services become essential.

Potential compliance disasters:

- GST violations

- Income tax notices

- Regulatory penalties

- Cross-border compliance issues

Many businesses depend on tax advisory firms in India to avoid these problems, but if you skip financial reviews, even the best advisors can’t help later.

Can Skipping Due Diligence Ever Be a Smart Move?

Q1. Is it ever a good idea to skip due diligence to close a deal faster?

No. While rushing a deal may seem tempting, skipping due diligence often leads to hidden risks like undisclosed debts, legal issues, and inaccurate financial data. Fast decisions without verification usually result in costly mistakes later.

Q2. Can I rely on trust or verbal promises instead of documents?

Not at all. Business decisions should always be based on verified financial records, contracts, and compliance documents. Trust is important, but documentation protects you from fraud and future disputes.

Final Takeaway:

Skipping due diligence is never a smart move it only creates short-term convenience and long-term problems. Proper verification ensures secure investments and sustainable growth.

How It Affects Investor Confidence & Valuation

Investors don’t just look at profits they look at risk exposure.

What investors expect:

- Clean financial records

- Transparent reporting

- Compliance proof

- Risk assessment reports

If you skip due diligence:

- Valuation drops

- Funding gets rejected

- Trust breaks

- Deals collapse

Modern investors even demand third-party due diligence services in india to validate every claim.

How DGA Global Protects You

At DGA Global, we help businesses avoid costly mistakes with expert financial analysis and strategic insights.

Why clients trust DGA Global:

- Industry-focused experts

- Tech-driven audit process

- Global compliance knowledge

- Startup & SME specialists

- Transparent reporting

We don’t just review numbers we protect your business future.

Conclusion

Skipping financial checks may seem like a shortcut but it often leads to long-term losses, legal trouble, and failed deals. In a fast-changing business world, smart leaders rely on financial due diligence services to make confident, risk-free decisions. Partnering with experts like DGA Global ensures your investments are protected, your numbers are verified, and your growth journey stays on track.

FAQs

Q1. What happens if you don’t do due diligence?

If you don’t do due diligence, you risk missing hidden debts, legal issues, and inaccurate financial information. This can lead to failed deals, financial losses, and damaged business reputation. In serious cases, it may also result in regulatory penalties and lawsuits.

Q2. Why is financial due diligence important?

Financial due diligence is important because it verifies a company’s true financial health before any major decision. It helps identify risks, hidden liabilities, and compliance gaps early. This ensures informed investments, safer acquisitions, and stronger business confidence.

Q3. What are the consequences of lack of due diligence?

The lack of due diligence can lead to financial losses, legal disputes, and regulatory penalties. It may also result in failed deals, overvalued investments, and damaged reputation. Overall, skipping due diligence puts a business’s growth and stability at serious risk.