Accounting financial advisory has become essential for businesses that deal with constant financial stress, compliance changes, and day-to-day accounting challenges. Whether it’s cash flow confusion, missed tax deadlines, or misreported numbers, small mistakes can quietly grow into bigger operational problems.

This blog explains how the right advisory approach helps businesses avoid everyday mistakes while improving financial clarity and long-term growth.

The Everyday Mistakes That Hurt Business Performance

Most business owners don’t recognize financial mistakes immediately; they only notice them when problems become too big to ignore. Here are some common issues that happen quietly in the background:

Frequent Mistakes

- Inaccurate bookkeeping entries

- Delayed invoicing and payment collection

- Misclassified expenses

- Missing proof for business expenses

- Lack of expense control

- Overlooking statutory compliance dates

- Running operations without cash-flow planning

Why These Happen

- No dedicated financial oversight

- Fast-growing business without systems

- Using outdated spreadsheets

- Relying on assumptions rather than data

- Limited knowledge of accounting tools

Even thriving businesses fall into these traps simply due to lack of consistent financial supervision.

The Hidden Cost of Small Financial Errors

Small errors compound over time. What looks like a minor accounting mistake today often becomes a much larger financial concern months later.

| Financial Mistake | Long-Term Impact |

| Wrong expense categorization | Incorrect profit reports |

| Delayed invoicing | Slow cash inflow & cash-flow pressure |

| Missed tax deadlines | Fines & penalties |

| No monthly reconciliation | Undetected discrepancies |

| Poor record-keeping | Difficulty in audits or funding rounds |

Business stability depends heavily on accuracy and this is where client advisory services play a key role by identifying risks before they get worse.

How Financial Advisory Solves Everyday Business Problems

A strong advisory approach offers both prevention and correction. Instead of reacting to financial problems, businesses start making informed decisions backed by real-time data.

What Advisory Brings to the Table

- Structured Accounting Systems

Clear processes for entries, approvals, invoicing, expense tracking, and reconciliation.

- Cash-Flow Monitoring

Forecasting inflows and outflows to avoid crises.

- Compliance Calendar Management

Tracking tax filings, audit requirements, and regulatory deadlines.

- Strategic Business Insights

Pricing decisions, budgeting, cost-control recommendations.

- Error-Free Financial Reporting

Accurate numbers lead to better decision-making and investor confidence.

This is why many fast-growing companies prefer professional accounting services in India to bring discipline, accuracy, and foresight into their financial system.

Financial advisory solves daily business problems by creating structured financial systems and maintaining compliance accuracy. It provides real-time insights for cash flow, budgeting, and decision-making. This is why fast-growing companies rely on professional accounting services in India for stability and error-free operations.

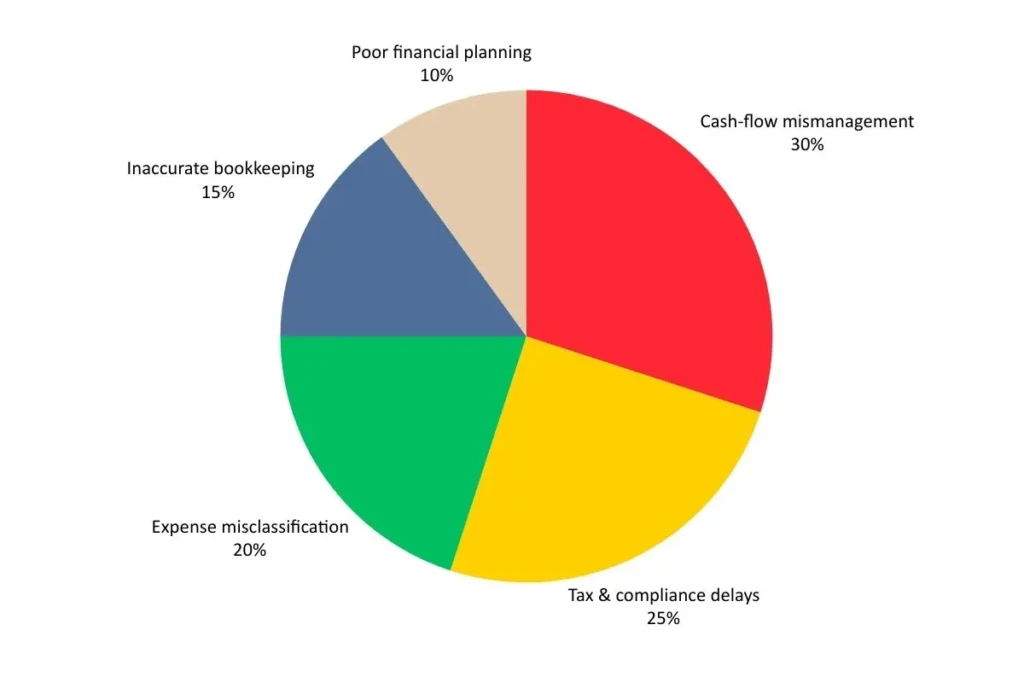

Where Businesses Slip Up the Most — Priority Risk Areas

Key Risk Zones Explained

1. Cash-Flow Mismanagement

- Slow billing cycles

- Poor collections

- Sudden expenses

2. Tax & Compliance Delays

- Missing filing deadlines

- Wrong interpretations of tax rules

- Late payments

3. Expense Misclassification

- No clarity on business vs personal expenses

- Over-spending without review

4. Inaccurate Bookkeeping

- Wrong entries

- No supporting documents

- Month-end reconciliation delays

5. Poor financial planning

- Decisions made without financial planning

- Hiring or expansion based on guesswork

These risk zones directly affect business stability, especially for companies managing growth phases.

Best Practices to Build a Strong Financial Foundation

To avoid recurring everyday mistakes, businesses must actively build strong financial habits.

Recommended Best Practices

- Create SOPs for financial tasks (billing, approvals, reimbursements)

- Ensure monthly reconciliations instead of waiting for year-end

- Use dedicated accounting software instead of manual spreadsheets

- Prepare a monthly cash-flow report

- Maintain a compliance checklist

- Conduct quarterly financial reviews

- Document every financial transaction properly

- Compare budgets vs actuals regularly

These practices reduce financial stress and improve financial predictability.

When Should a Business Seek Professional Advisory?

Many businesses wait too long before seeking help, but the right time is usually when you start noticing patterns like:

You Need Advisory When:

- You struggle to understand monthly profit numbers

- Cash flow never seems stable

- Tax deadlines feel overwhelming

- Your business is growing but finances look cluttered

- You want to expand but don’t have clear financial projections

- You’re unsure how to price services or manage margins

This is where experienced advisors step in including trusted tax advisory firms in India to ensure your daily operations run smoothly and your future decisions stay financially strong.

Businesses should seek professional advisory the moment financial reports feel unclear, cash flow becomes inconsistent, or compliance deadlines create stress. As operations grow, advisors help simplify cluttered finances, provide accurate projections, and guide strategic decisions. Partnering with trusted tax advisory firms in India ensures stability, compliance, and smarter financial planning.

Conclusion

Everyday financial mistakes may seem small, but their impact is long-lasting. With the right system, advisory support, and structured financial processes, businesses can eliminate errors, strengthen financial discipline, and improve decision-making. A reliable advisory partner ensures accuracy, compliance, and long-term financial stability giving business owners the confidence to focus on growth.

To build stronger financial systems, streamline operations, and maintain compliance, expert accounting firm services can make all the difference.

FAQs

Q1. How do you correct errors in financial accounting?

Errors in financial accounting are fixed by reversing the wrong entry and recording the correct one with proper documentation. Regular reconciliations help catch mistakes early. Many businesses also take advisor support to prevent repeat errors.

Q2. How do you solve financial accounting problems?

Financial accounting problems are solved by reviewing records, identifying the root cause, and correcting entries with proper documentation. Using reliable accounting software and monthly reconciliations helps prevent recurring issues. Many businesses also consult advisors to ensure accuracy and compliance.

Q3. What are financial advisory services in accounting?

Financial advisory services in accounting help businesses make better financial decisions through budgeting, cash-flow planning, compliance guidance, and risk management. These services improve accuracy, reduce errors, and strengthen financial health. Advisors also provide strategic insights that support growth and long-term stability.