In today’s highly interconnected economy, global valuation services are becoming the gold standard for informed and strategic investment decisions. With investment capital flowing seamlessly across borders, investors in 2025 demand valuation processes that are accurate, fast, and globally consistent.

Whether it’s private equity firms assessing multi-million-dollar acquisitions, venture capitalists backing the next unicorn, or multinational corporations expanding into new territories, the need for precise valuation has never been greater. Inaccurate valuations not only jeopardize returns but can also damage investor trust, derail deals, and lead to compliance risks in multiple jurisdictions.

In this blog, we will explore how global valuation services combined with offshore expertise, technology, and evolving market strategies are transforming investments worldwide.

Why Accurate Business Valuation Is Crucial for Global Investment Decisions in 2025

A business valuation is much more than a number on a spreadsheet; it’s the financial DNA of an enterprise. In 2025, with volatile markets, regulatory changes, and global competition, the margin for error is razor-thin.

Key reasons accurate valuations are vital now:

- Market Volatility: Fluctuating currencies, political instability, and sudden market shifts require valuations that reflect current realities.

- Cross-Border Compliance: Investments today often involve multiple jurisdictions, each with its own legal, tax, and accounting frameworks.

- Investor Confidence: Reliable valuations build trust among investors, making it easier to secure funding or close deals.

- Risk Mitigation: Accurate valuations highlight potential risks before capital is deployed.

Impact of Accurate vs. Inaccurate Valuations on Investment Outcomes

| Factor | Accurate Valuation | Inaccurate Valuation |

| Investment ROI | High & Sustainable | Low & Risky |

| Risk Assessment | Clear & Measurable | Vague & Unreliable |

| Investor Confidence | Strong | Weak |

| Decision-Making Speed | Faster | Delayed |

| Compliance Risk | Low | High |

How Offshore Accounting Is Fueling Faster and Smarter Investment Assessments

Off shore accounting has shifted from being a back-office support function to a strategic driver of investment decision-making. In 2025, the pace of investment deals and the need for high-accuracy valuations make offshore accounting a game-changer for investors across industries.

By integrating global expertise, advanced technology, and round-the-clock operations, offshore accounting teams are not just delivering faster results they’re enhancing the quality and depth of investment assessments.

Why Offshore Accounting is Speeding Up Valuation Processes

- 24/7 Work Cycles: Leveraging time-zone differences to ensure continuous progress on projects.

- Dedicated Specialist Teams: Access to valuation analysts with niche expertise in specific industries such as fintech, renewable energy, or biotech.

- Reduced Administrative Bottlenecks: Offshore teams handle large data preparation tasks, freeing onshore teams for strategic decisions.

- Automation & AI Tools: Use of RPA (Robotic Process Automation) and AI to speed up data analysis, scenario testing, and financial modeling.

- Access to Diverse Data Sources: Offshore analysts often have subscriptions and access to multiple global databases for richer market insights.

Benefits for Smarter Investment Assessments

- Risk Identification Early On: Offshore teams can flag regulatory, market, or operational risks before they escalate.

- Scenario-Based Valuation: Ability to test multiple market or operational scenarios in parallel, leading to better-informed decisions.

- Scalable Workforce: Easily expand or contract team size based on deal flow without the cost of permanent hires.

- Cross-Border Compliance Expertise: Ensures valuations meet both local and international regulatory standards.

- Cost Savings Reinvested in Analysis: Lower operational costs free up budgets to invest in deeper due diligence.

Why Investors Are Shifting from Local CPAs to Offshore Valuation Experts in 2025

In the past, investors preferred working with local CPAs for valuation services. But in 2025, the tide has shifted toward offshore experts and for good reason.

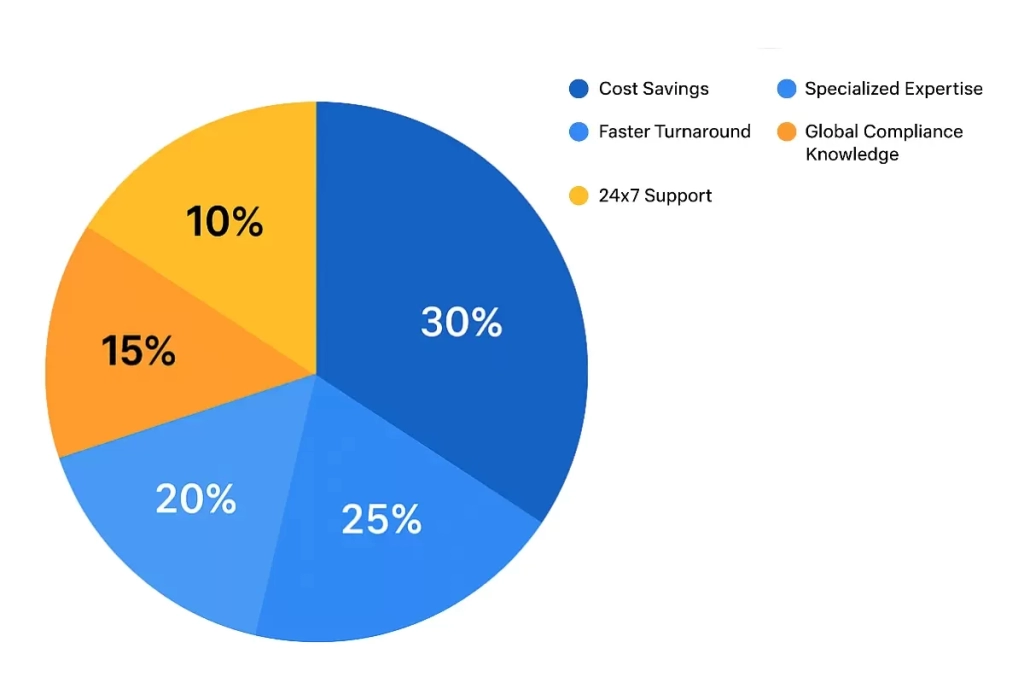

Top drivers for the shift:

- Specialization: Offshore valuation teams often dedicate themselves solely to valuation, rather than juggling multiple accounting functions.

- Cost Efficiency: Offshore solutions offer high-quality services at significantly reduced costs.

- Scalability: Offshore teams can easily scale to meet the needs of large, multi-market investment projects.

- Global Compliance Expertise: Familiarity with international accounting standards such as IFRS and US GAAP.

Factors Driving the Shift to Offshore Valuation Experts

How Indian Offshore Companies Are Revolutionizing Startup Valuation Models

Indian offshore companies are emerging as game changers in startup valuations. Their approach combines technology, industry-specific insights, and flexible pricing models that attract early-stage and growth-stage startups alike.

Innovations brought by Indian offshore companies:

- AI-Powered Forecasting: Predict future revenue growth scenarios based on historical and market data.

- Sector-Specific Multiples: Use benchmarks tailored to industries like e-commerce, biotech, or renewable energy.

- Hybrid Valuation Models: Combine DCF (Discounted Cash Flow) with market comparables for accuracy.

- Global Investor Readiness Reports: Provide documentation designed to meet global investor expectations.

Why Private Equity Firms Are Relying More on Offshore Valuation Services

Private equity (PE) firms have complex needs; they evaluate multiple deals at once, often across various countries and industries. Offshore valuation services meet these needs efficiently.

Benefits for PE firms:

- Deal Volume Management: Offshore teams handle large-scale evaluations without compromising on detail.

- Cross-Border Expertise: Familiarity with investment regulations in multiple regions.

- Tech Integration: Use of big data analytics for trend predictions and risk scoring.

Local vs Offshore Valuation Services for Private Equity

| Criteria | Local Services | Offshore Services |

| Cost | Higher | Lower |

| Turnaround Time | Moderate | Faster |

| Global Compliance | Limited | Strong |

| Tech Adoption | Moderate | Advanced |

| Deal Scalability | Limited | High |

Conclusion: Offshore to India — A Strategic Shift for Smarter Investments

In 2025, the move offshore to India for valuation services is more than a cost-cutting measure it’s a strategic leap toward accuracy, agility, and global competitiveness. From startups to large-scale private equity deals, the combination of global valuation services and offshore expertise enables investors to act faster, reduce risks, and seize opportunities worldwide.

As markets grow increasingly complex, the investors who leverage offshore capabilities will not just keep pace with the competition they’ll set the pace.

FAQs

Q1. What is global valuation?

Global valuation refers to the process of determining the overall market value of assets, businesses, or investments across multiple countries, considering factors like currency exchange rates, international market trends, and cross-border regulations.

Q2. What are the three types of property valuation?

The three main types of property valuation are the Sales Comparison Method (comparing similar properties), Income Capitalization Method (based on rental income potential), and Cost Approach (calculating land and construction costs minus depreciation).

Q3. Is it worth getting a valuation?

Yes, getting a valuation is worth it as it provides an accurate picture of your business’s financial worth, helping in informed decision-making. It’s essential for investment, mergers, fundraising, or strategic growth planning.