Auditing services have taken on a much bigger role since Union Budget 2026 was announced, even though most business owners initially focused on taxes, incentives, and compliance reliefs. Quietly in the background, the budget has also changed how audits are viewed especially for SMEs and startups that are trying to grow in a responsible and structured way.

For many founders, audits still feel like a once-a-year formality. Something you simply “get done” because the law requires it. Budget 2026 pushes back against that thinking. It nudges businesses toward cleaner books, stronger internal controls, and clearer financial visibility whether they feel fully prepared for it or not.

Let’s break this down in a simple, practical way.

What Actually Changed for SMEs After Budget 2026

If you run an SME, Budget 2026 probably didn’t feel dramatic at first. No big “audit headline,” no shocking rule. But the impact shows up slowly when filings get checked more closely, when banks ask sharper questions, or when benefits require clearer documentation.

Earlier, many SMEs managed audits with a minimal approach. As long as numbers matched and reports were filed, things moved on. That comfort zone is shrinking.

What’s happening now is simple:

- Financial records are expected to be cleaner.

- Explanations must actually make sense.

- Inconsistencies get noticed faster.

This is why more businesses are turning to structured Audit Firm Services instead of informal or last-minute audits. Not because they want to spend more but because fixing mistakes later costs much more.

Audits are no longer about “passing.” They’re about being believable.

Startup Audits Feel Different Now — And Founders Can Sense It

Startups don’t think in years. They think in months, sometimes weeks. Cash burn, hiring, funding everything moves fast. Audits used to feel slow and disconnected from reality.

Budget 2026 changes that dynamic.

Investors, regulators, and even internal teams now expect audit reports to reflect how the business actually runs, not how it was planned to run.

Here’s where startups are feeling pressure:

- Revenue numbers that don’t match cash flow.

- ESOP structures that were never properly documented.

- Expenses booked late or without clear purpose.

- Gaps between financial statements and investor decks.

None of this was ignored earlier but now it’s questioned more openly.

A solid audit doesn’t just reduce risk. It makes conversations easier during funding rounds.

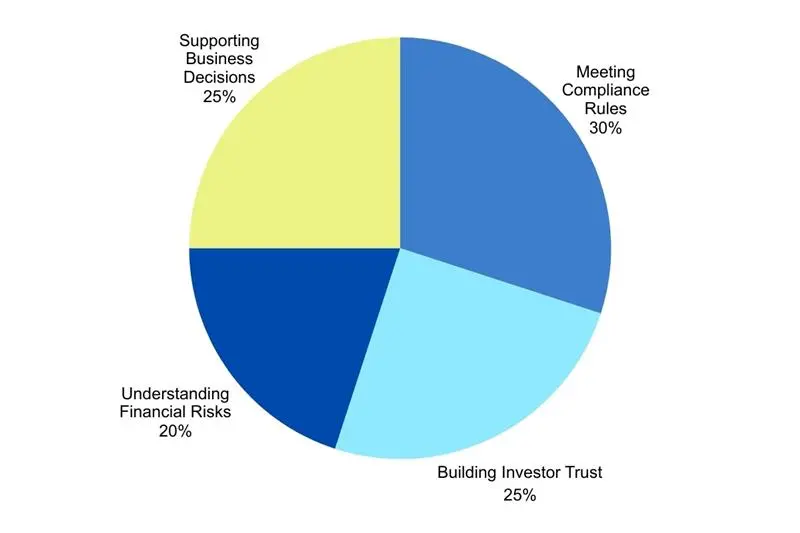

Why Businesses Take Audits More Seriously Now

What this really shows is that audits aren’t serving just one purpose anymore. They’re doing multiple jobs at once.

Why Offshore Audits Are Becoming Normal (Not Risky)

There’s a common misunderstanding that offshore audits are only about cutting costs. That’s not entirely true.

After Budget 2026, timelines are tighter and expectations are higher. Businesses still want quality, but they also want efficiency. That balance is hard to achieve with traditional models alone.

This is where offshore audit services start making sense.

Companies aren’t outsourcing responsibility. They’re optimising effort.

Working with an audit offshoring firm in India allows SMEs and startups to:

- Handle workload peaks smoothly

- Access experienced professionals

- Maintain audit quality without expanding internal teams

For businesses with overseas operations or investors, this model fits naturally. It’s practical, not experimental.

Audits Are Slowly Turning Into a Management Tool

This is something founders don’t realise immediately.

Audits used to look backward. They checked what already happened. Today, they’re starting to point forward.

Modern audits now touch areas like:

- How predictable your cash flow really is

- Whether controls are strong enough for scaling

- Where financial risks might appear next year, not last year

That’s a big shift.

How Audits Feel Different Today

| Earlier | Now |

| Annual task | Ongoing reference |

| Compliance-driven | Insight-driven |

| Static reports | Practical observations |

| Low involvement | Active discussions |

When audits are done right, they quietly improve decision-making across the business.

Is Budget 2026 Making Audits More Stressful?

This is a question many SME owners ask — and honestly, the answer depends on preparation.

Are audits stricter now?

Yes. Sloppy documentation and vague explanations don’t slide easily anymore.

Are audits more helpful?

Also yes. Businesses that engage early with audits face fewer surprises later.

In many cases, audits are preventing problems instead of highlighting them after damage is done.

What SMEs and Startups Should Honestly Do Next

No complicated strategy is needed.

Just a few sensible steps:

- Stop treating audits as a year-end formality

- Keep records updated throughout the year

- Ask auditors questions instead of avoiding them

- Use audit feedback to improve systems, not defend mistakes

Businesses that do this find audits becoming easier every year.

Final Thoughts

Budget 2026 didn’t suddenly make audits difficult. It made expectations clearer.

SMEs and startups that adapt will find audits supporting growth instead of slowing it down. When audits are combined with practical insights and long-term thinking through client advisory services, they become part of the business strategy not a compliance headache.

At this point, audits aren’t just about rules. They’re about readiness.

FAQs

Q1. How will audit change in the future?

In the future, audits will move beyond basic compliance and focus more on real-time financial accuracy and risk identification. Businesses will rely on audits to gain clearer insights into cash flow, controls, and decision-making. Audits will also become more technology-driven, faster, and closely linked to business strategy rather than just annual reporting.

Q2. What are the changes in budget 2026?

Budget 2026 focuses on stronger financial transparency, wider digital compliance, and tighter monitoring of business records. It encourages better documentation, improved internal controls, and accountability, especially for SMEs and startups. Overall, the budget aims to make businesses more structured, compliant, and investment-ready.

Q3. What tax changes are coming in 2026?

Budget 2026 brings simpler tax compliance, clearer rules, and fewer disputes for businesses and individuals. Existing tax slabs largely remain the same, but processes are streamlined to reduce filing complexity. The focus is on transparency, ease of compliance, and faster tax administration.