Global bookkeeping and tax solutions are no longer just “nice to have” for growing businesses. They have quietly become one of the most practical ways to stay in control when your operations start crossing borders.

Ask any founder or finance manager handling more than one country, and you’ll hear the same thing it’s not growth that feels overwhelming, it’s keeping up with different tax rules, filing dates, currencies, and reporting standards.

So the real question is simple: Can one global system actually manage all this without creating more confusion?

Let’s break it down honestly.

Why Managing Taxes Across Countries Feels Overwhelming

At first, multi-country operations sound exciting. New markets. New customers. Bigger numbers.

Then reality kicks in.

Suddenly, you’re dealing with:

- Different tax structures in every country.

- Separate deadlines for filings and payments.

- Rules that change without much warning.

- Reports that don’t match because currencies don’t behave the same way.

Even experienced teams struggle here. It’s not about effort — it’s about complexity.

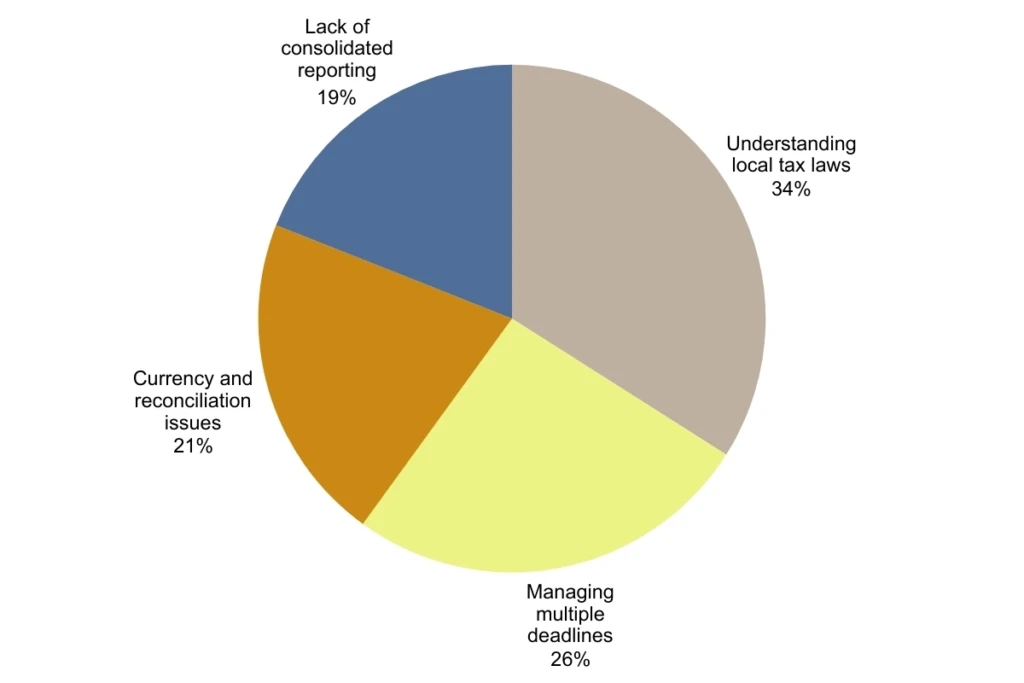

What Usually Causes the Most Tax Stress?

Most problems are operational, not strategic. And that’s important — because operational problems can be fixed with the right structure.

How Global Bookkeeping and Tax Solutions Actually Help (In Real Life)

Instead of juggling separate systems and advisors in every country, global solutions bring everything under one roof.

Not by ignoring local rules but by organising them.

Here’s what changes once a business switches to a global model:

- All transactions are recorded in one structured system.

- Country-specific tax rules are applied correctly in the background.

- Reports finally start “talking to each other”.

- Management gets one clear financial picture.

The biggest difference?

You stop reacting to problems and start planning ahead.

Why Businesses Worldwide Look Toward India for Accounting Support

There’s a reason many international companies rely on accounting services in india. It’s not just about cost that’s only part of the story.

Indian accounting professionals work daily with:

- International tax frameworks.

- Global compliance standards.

- Cross-border clients and time zones.

They understand how different systems connect. That experience matters when mistakes can mean penalties or audits.

When handled properly, offshore accounting doesn’t feel “offshore” at all. It feels structured, responsive, and reliable.

Why Small Businesses Benefit the Most From Global Solutions

Large corporations can afford in-house tax departments. Smaller businesses usually can’t — and honestly, they shouldn’t have to.

For growing companies, accounting services for a small business need to be flexible and practical.

What small businesses usually need:

- One point of contact.

- Predictable monthly costs.

- Zero compliance surprises.

- Advice that’s easy to understand.

Traditional Setup vs Global Solution

| Area | Traditional Setup | Global Solution |

| Cost | High & fixed | Flexible & scalable |

| Expertise | Limited by location | Multi-country |

| Compliance risk | Easy to miss | Actively managed |

| Visibility | Scattered reports | Single dashboard |

The goal isn’t complexity. It’s clarity.

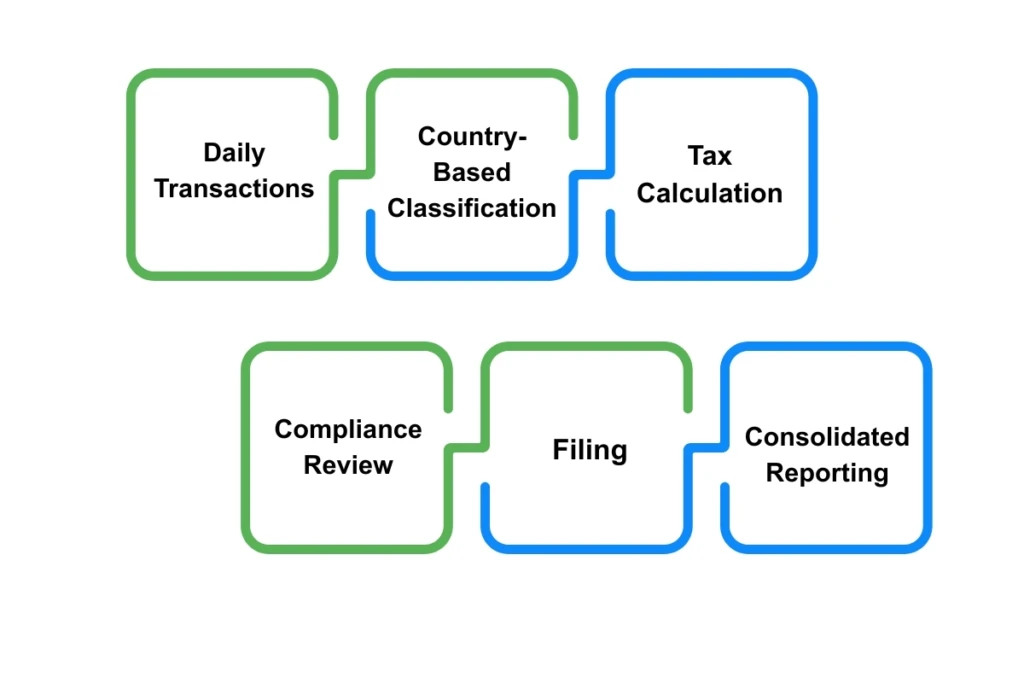

What the Global Tax Workflow Looks Like Behind the Scenes

Many people imagine global tax handling as complicated. In reality, it follows a clean, repeatable process.

Every step has checks built in. Nothing moves forward blindly. That’s how accuracy is maintained even at scale.

Mini Blog: Can One Partner Really Handle Taxes in Multiple Countries?

This question comes up often — and fairly so.

1. How Local Rules Are Still Followed

A global partner doesn’t ignore local laws. They track them closely. Country-wise tax requirements are handled separately but managed centrally, so nothing gets lost.

2. Why Centralised Reporting Makes Decisions Easier

Instead of ten different reports from ten countries, leadership sees one clear view. Cash flow, liabilities, and tax exposure finally make sense together.

That clarity alone is a game-changer.

Why Experience and Trust Matter More Than Tools

Software helps. Systems help.

But when it comes to taxes, experience matters more.

Businesses need partners who:

- Understand changing regulations.

- Maintain confidentiality.

- Communicate clearly.

- Take responsibility, not shortcuts.

This is where firms like DGA Global stand out not by promising shortcuts, but by building processes that actually work over time.

Final Thoughts

Managing taxes across countries doesn’t have to feel risky or exhausting. With the right structure and guidance, it becomes manageable — even predictable.

For businesses planning to grow globally, choosing a reliable bookkeeping and tax service isn’t just about compliance. It’s about peace of mind, better decisions, and sustainable growth.

FAQs

Q1. How does global taxation work?

Global taxation means a business pays tax in the countries where it actually earns money. Each country has its own tax rules, so taxes are handled separately. Some agreements are there just to make sure the same income isn’t taxed twice.

Q2. What is the Global Tax Platform?

A Global Tax Platform is simply one system used to manage taxes for different countries. It helps keep tax details, calculations, and filings in one place. This saves time and avoids confusion when dealing with international taxes.

Q3. What is the global tax rule?

The global tax rule is a general way countries decide how to tax international businesses. It focuses on taxing income where real work or business happens. This helps keep things fair and more transparent.