In today’s fast-moving financial landscape, businesses around the world are increasingly considering whether to team up with offshore service providers in India or stick with local, onshore accounting solutions. When it comes to handling finances, more and more companies are facing a familiar question: should we keep things local, or look abroad for help?

With offshore service providers in India offering competitive rates and skilled talent, it’s tempting—but onshore accounting has its own perks, especially when it comes to staying close to home and on top of local regulations. So, what’s the better fit? Let’s unpack both options and see what makes the most sense for your business.

What is Offshore and Onshore Accounting?

Offshore Accounting

Offshore accounting refers to outsourcing accounting functions to firms in a different country. It’s often used to save costs and access a wider talent pool. This approach is a key part of offshoring accounting services for many global companies.

Onshore Accounting

Onshore accounting involves hiring firms within the same country as your business. This model allows for closer collaboration and better alignment with local regulations.

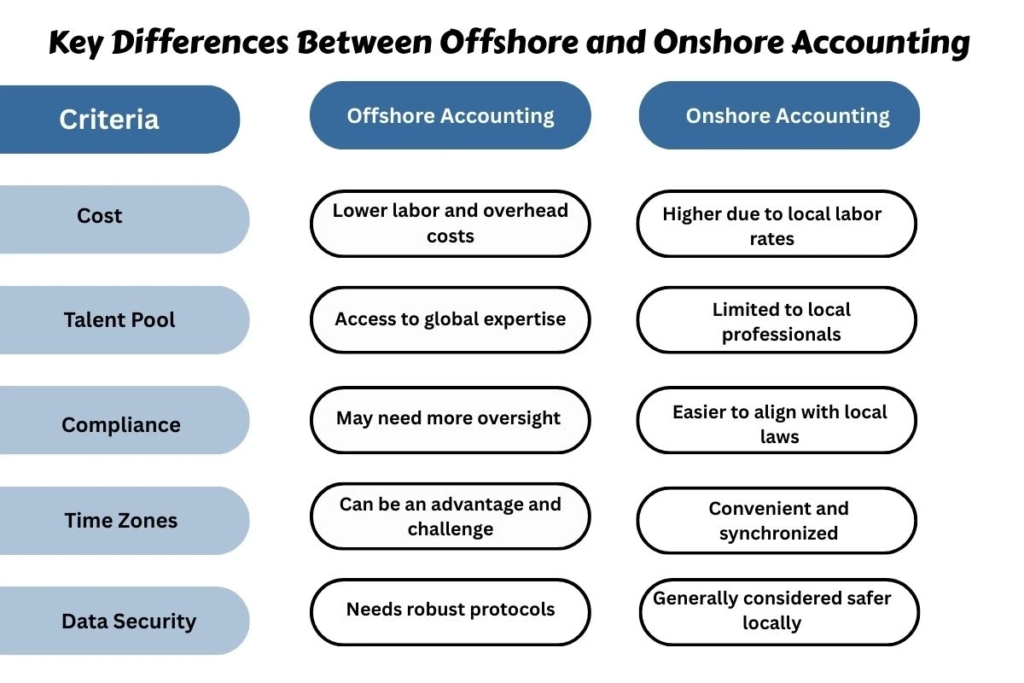

Key Differences Between Offshore and Onshore Accounting

1. Cost

Offshore: Businesses benefit from reduced wages and operating expenses, especially in developing countries.

Onshore: Higher wages, benefits, and office expenses contribute to a greater cost.

2. Talent Pool

Offshore: Broader access to professionals with specialized skills in global accounting standards.

Onshore: More limited to local labor markets which may constrain hiring options.

3. Compliance

Offshore: Requires extra diligence to ensure international standards and cross-border regulations are met.

Onshore: Compliance is more straightforward since it’s governed by domestic regulations.

4. Time Zones

Offshore: Offers flexibility with overnight processing but can delay real-time communication.

Onshore: Shared business hours ensure easier coordination and faster turnarounds.

5. Data Security

Offshore: Strong security protocols and legal agreements are essential to mitigate risks.

Onshore: Proximity and local laws make enforcing data protection easier and often more reliable.

When to Choose Offshore Accounting

- Budget is tight, and cost savings are a priority.

- Business requires 24/7 support across time zones.

- Need access to international financial expertise.

Suggestion: Companies looking to expand globally often choose off shore accounting for broader market adaptability.

When to Choose Onshore Accounting

- Business requires in-person collaboration.

- Frequent communication and immediate feedback are necessary.

- Strong emphasis on local tax laws and government compliance.

Best Fit: Domestic startups and SMEs that need close, local support.

Final Thoughts

Choosing between offshore and onshore accounting models depends on your company’s unique goals and circumstances. Evaluate your priorities, consider cost vs. compliance, and don’t shy away from seeking expert advice.

Whether you choose to go offshore to India or stay local, making an informed choice will support your long-term financial health and business growth.

FAQs

- What is offshore and onshore account?

Offshore accounting involves outsourcing financial tasks to firms in another country to reduce costs and access global expertise, while onshore accounting refers to handling those tasks locally for better compliance and communication. - Why is it called offshore accounts?

The term “offshore accounts” is used because businesses delegate their accounting operations to service providers outside their home country, typically across international borders. - What is the onshore process?

The onshore process refers to managing accounting functions within the same country as the business, ensuring better communication, compliance with local laws, and immediate support.