In 2025, auditing services are no longer just a regulatory necessity they’re a strategic asset. From mid-sized firms to billion-dollar corporations, businesses across the U.S. are rethinking their financial strategies with the help of specialized audit tax advisory services. These services are acting as a bridge between compliance and competitiveness in a volatile global market.

What Makes Audit Tax Advisory Services Critical for U.S. Business Growth

Audit tax advisory services are now vital tools for business strategy and resilience. Here’s why:

1. Data-Driven Financial Insights

- Auditors analyze financial records to identify performance gaps, inefficiencies, and growth opportunities.

- These insights help companies make data-backed decisions that align with long-term goals.

- Trends in spending, profitability, and resource allocation are mapped for strategic planning.

2. Navigating Regulatory Complexity

- U.S. tax laws are frequently updated at both federal and state levels, creating compliance challenges.

- Audit tax advisors ensure businesses meet all legal requirements and avoid costly penalties.

- They also guide companies through industry-specific regulations and international compliance frameworks.

3. Strengthened Risk Management

- Comprehensive audits expose internal financial inconsistencies, fraud risks, and weak controls.

- Especially critical during high-stake activities like M&A, IPOs, or global expansion.

- They help in identifying and mitigating both financial and operational risks proactively.

4. Digital Integration & Real-Time Reporting

- Modern audit practices integrate with ERP, accounting software, and AI-based platforms.

- Enables continuous auditing, real-time data access, and quicker decision-making.

- Reduces manual errors, enhances transparency, and improves reporting speed.

How U.S. Companies Are Tapping Into Offshore Audit Services for Efficiency

In 2025, offshore audit services offer more than savings—they provide tech expertise, speed, and innovation.

Strategic Reasons Beyond Cost:

- Specialized Knowledge: Offshore teams bring niche expertise like ESG audits and crypto-related compliance.

- Regulatory Forecasting: Predictive tools help businesses prepare for policy changes in advance.

- Audit Innovation Labs: Top firms test blockchain and AI models to improve audit speed and accuracy.

- Sustainability Compliance: Firms assist with ESG audit readiness and sustainability reporting.

Table: Traditional vs. Strategic Offshore Audit Approaches

| Dimension | Traditional Outsourcing | Strategic Offshore Partnership |

| Focus | Cost & Turnaround | Insights & Innovation |

| Expertise | General Staff | Domain Specialists |

| Tech Capability | Basic Tools | AI, Blockchain, Predictive Analytics |

| Compliance Strategy | Reactive | Proactive + Forward-Looking |

| Relationship Model | Vendor | Long-term Strategic Partner |

Insight: Strategic partnerships drive transformation, not just transactions.

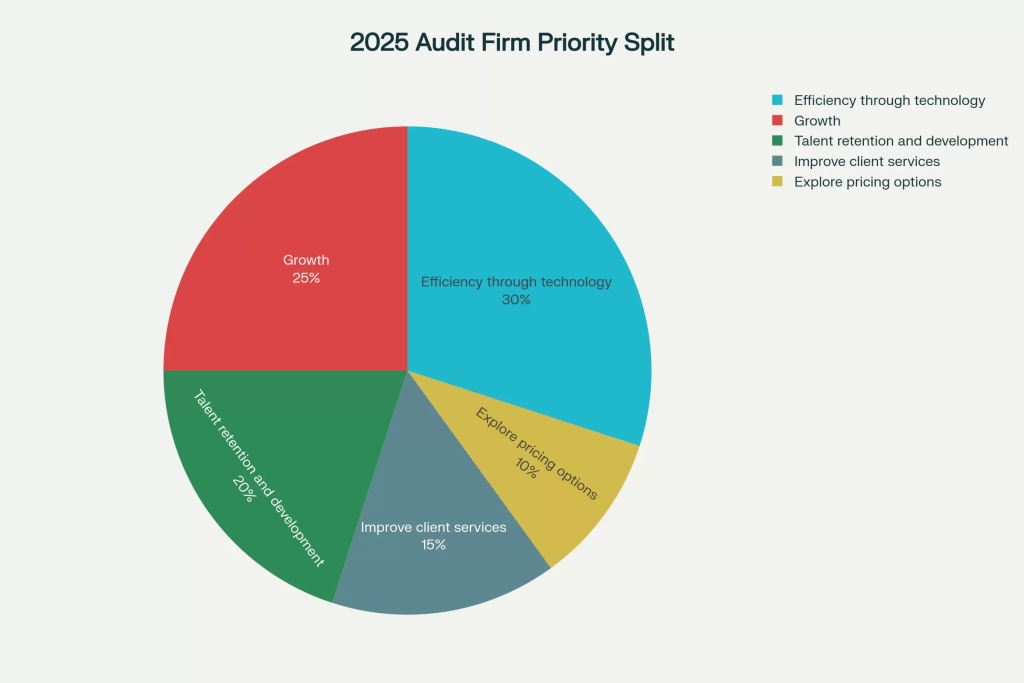

Audit Firm Priorities Distribution in 2025

How Startups and SMEs in the U.S. Benefit from Outsourced Auditing Services

Startups and small-to-medium enterprises (SMEs) in the U.S. often operate with limited budgets and lean teams. Outsourced auditing services help them stay compliant, avoid errors, and make informed financial decisions all without the high costs of in-house audit departments.

1. Cost Savings Without Sacrificing Quality

- Lower Operational Costs

Hiring a full-time in-house audit team can be expensive. Outsourcing allows startups to pay only for the services they need—monthly, quarterly, or annually. - Affordable Access to Experts

Even small businesses get access to qualified CPAs, financial analysts, and audit technology through outsourcing.

2. Better Financial Accuracy from Day One

- Error-Free Books

Offshore auditors bring strong quality control and ensure books are up-to-date and accurate, reducing risks during tax filings or funding rounds. - Audit-Ready Financials

SMEs benefit from having their financials in audit-ready format, which builds trust with investors, partners, and regulatory bodies.

3. Smarter Decision-Making Through Professional Insights

- Performance Monitoring

Auditors provide monthly or quarterly reports with financial KPIs and trend analysis that help startups spot problems early. - Strategic Advice

Many outsourced firms go beyond audits and suggest improvements for cost control, cash flow, and tax planning.

4. Flexibility and Scalability as They Grow

- On-Demand Expertise

Startups can begin with basic audit services and scale up as their needs grow—like adding internal control testing or due diligence reviews. - No Long-Term Contracts

Outsourced auditing offers flexible engagement models, which is ideal for growing businesses that can’t commit to full-time hires.

5. Time Savings for Founders and Teams

- More Focus on Core Business

By outsourcing audit tasks, founders and finance heads can focus on sales, product, and customer growth instead of worrying about compliance. - Faster Turnaround Times

Offshore audit teams work round-the-clock, often delivering reports and reconciliations much quicker than local teams.

What to Look for When Choosing Offshore Audit Services in 2025

Selecting the right offshore audit partner is more than a cost decision—it’s a strategic choice that directly impacts your compliance, reporting accuracy, and operational transparency. Here’s what U.S. businesses should prioritize when exploring offshore audit firm services in 2025:

- Expertise in U.S. Laws: Providers must understand U.S. tax codes, industry standards, and regulatory requirements, ensuring flawless compliance.

- Proven Track Record: Look for extensive experience, positive client testimonials, and recognized certifications.

- Technology Stack: Ensure the firm uses advanced software for audit management, analytics, and secure collaboration.

- Data Security: Confirm robust data protection policies, confidentiality agreements, and adherence to U.S. and international security norms.

- Transparent Pricing and Flexibility: Evaluate service scope, fee structures, and scalability to fit your growth plans.

- Communication and Support: Choose partners with responsive support, regular reporting, and effective project management.

Conclusion: Strategic Role of Offshore Audit Services in 2025

As the financial landscape becomes increasingly complex, offshore audit services have moved from the sidelines to center stage in U.S. business strategy. By leveraging these global partnerships, companies are achieving greater compliance, faster reporting, and deeper financial insights. The shift is clear: audit tax advisory services are no longer just about numbers they’re about navigating change with confidence.

FAQs

Q1. How can we improve audit quality?

To improve audit quality, firms should invest in continuous training, adopt advanced audit technologies, and strengthen internal review processes. Ensuring independence and adhering to updated regulatory standards also play a key role.

Q2. How do you reduce the errors in your audit?

To reduce errors in an audit, we implement standardized procedures, use data analytics tools for accuracy, and conduct multiple review layers. Regular staff training and quality control checks further minimize risks.

Q3. What is the best way to audit something?

The best way to audit something is by following a structured process: plan the audit, assess risks, gather and analyze evidence, and document findings clearly. Using digital tools and maintaining objectivity enhances accuracy and efficiency.