In 2025, due diligence services are no longer optional; they are a strategic necessity for businesses and investors navigating today’s complex, high-stakes markets. Whether you are a venture capitalist in San Francisco, a family office in London, or a corporate leader planning a merger, due diligence ensures that every investment decision is backed by facts, not assumptions.

Explore what due diligence is, the core types used globally, the benefits it delivers, and why India has become a global leader in delivering these services efficiently and effectively.

What Are Due Diligence Services and Why Do They Matter in 2025?

At its core, due diligence is a structured investigation and verification process conducted before entering into a major transaction such as a merger, acquisition, partnership, or investment. It involves reviewing financial records, legal agreements, operations, and other critical factors to uncover any risks or hidden issues.

In 2025, due diligence matters more than ever because:

- Global Economic Uncertainty – Currency fluctuations, inflation spikes, and shifting trade agreements make business riskier.

- Regulatory Pressure – In both the US and UK, new compliance laws in data privacy, ESG (Environmental, Social, Governance), and tax have made legal oversight more complex.

- Digital Threat Landscape – Cybercrime costs are projected to hit $10.5 trillion annually by 2025, making IT risk checks essential.

- Investor Expectations – Shareholders demand transparency and risk-proofing before capital commitments.

Why this matters:

Skipping even one step can lead to costly surprises such as undisclosed debts, ongoing litigation, or inflated valuations all of which can derail a deal.

Understanding the Core Types of Due Diligence Services Used Globally

Different deals require different types of due diligence. Here are the most common ones:

| Type | Purpose | Key Checks |

| Financial | Assess fiscal health | Revenue trends, debt levels, assets & liabilities |

| Legal | Identify legal risks | Contract compliance, ongoing litigations |

| Operational | Evaluate internal efficiency | Supply chain reliability, staff capabilities |

| Commercial | Check market viability | Market share, competitor landscape |

| IT & Cybersecurity | Ensure data protection | Network security, software compliance |

1. Financial – Assess Fiscal Health

- Analyze revenue growth trends over the past 3–5 years to identify stability or volatility.

- Review profit margins to assess operational efficiency and cost control.

- Examine debt-to-equity ratio and other leverage metrics to evaluate financial risk.

- Verify asset valuations including tangible (property, equipment) and intangible (IP, goodwill) assets.

- Check cash flow statements to determine liquidity and ability to meet short-term obligations.

2. Legal – Identify Legal Risks

- Review all existing contracts to ensure terms are favorable and legally compliant.

- Check for pending or ongoing litigations that may impact business reputation or finances.

- Verify intellectual property rights and ensure trademarks, copyrights, and patents are secured.

- Assess compliance with industry-specific regulations and government laws.

- Identify potential employment disputes related to contracts, terminations, or benefits.

3. Operational – Evaluate Internal Efficiency

- Assess supply chain reliability and identify risks of dependency on single vendors.

- Review production capacity to meet current and projected market demand.

- Analyze management structure for decision-making speed and efficiency.

- Check employee skill levels and training programs to ensure workforce competency.

- Identify process automation opportunities to reduce costs and improve output quality.

4. Commercial – Check Market Viability

- Assess market share trends compared to competitors over the last few years.

- Review pricing strategy and its alignment with market demand and customer perception.

- Evaluate customer base diversity to avoid overdependence on a few clients.

- Identify emerging competitors and potential disruptive innovations in the market.

- Analyze sales channel performance (online, retail, distributors) for profitability.

5. IT & Cybersecurity – Ensure Data Protection

- Audit network security measures like firewalls, encryption, and intrusion detection systems.

- Verify data backup protocols and disaster recovery plans.

- Review software licensing compliance to avoid legal penalties.

- Assess access control systems to ensure only authorized personnel can handle sensitive data.

- Test incident response readiness for handling cyberattacks or breaches.

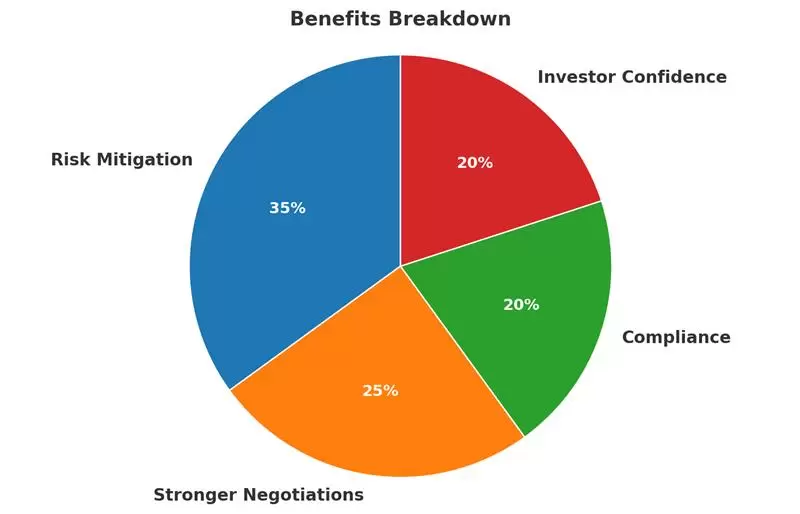

Top Benefits of Conducting Due Diligence Before a Strategic Partnership

Conducting thorough due diligence can make or break a deal. Here’s how it adds value:

1. Risk Mitigation

- Identifies potential liabilities, regulatory violations, or operational bottlenecks before contracts are signed.

- Example: An investor avoided buying a profitable software firm when due diligence uncovered unlicensed third-party code in its products, which could have led to legal action.

2. Stronger Negotiations

- Concrete data allows buyers to negotiate better terms, lower acquisition prices, or request risk-mitigation clauses.

- Example: A US firm reduced the acquisition price of a logistics company by 15% after discovering aging fleet equipment through operational due diligence.

3. Compliance

- Ensures the target company adheres to all relevant laws — from tax codes to employment regulations reducing post-deal legal headaches.

4. Investor Confidence

- Transparency during due diligence builds trust with stakeholders, making it easier to raise capital or secure loans.

How Due Diligence Services in India Are Powering Global Investment Strategies

From India’s expertise to global boardrooms here’s the chain of impact:

| Action in India | Ripple Effect Globally |

| High-precision market & compliance checks | Multinational investors reduce risk before entering new markets |

| Sector-specific financial deep dives | Companies target the most profitable industries with data-backed confidence |

| Advanced fraud detection & forensic audits | Prevents cross-border scams and protects multi-million-dollar deals |

| Cultural & regulatory intelligence gathering | Smooth entry into diverse markets without compliance pitfalls |

| Tech-enabled, rapid turnaround reporting | Global decision-makers act faster than competitors |

Conclusion

In an interconnected business world, due diligence is your first line of defense against financial loss, legal trouble, and reputational damage. From identifying hidden risks to empowering better negotiations, it ensures your business moves are informed and secure.

And when paired with professional accounting services in India, due diligence becomes even more powerful combining financial clarity with strategic risk management to help global businesses succeed in the US, UK, and beyond.

FAQS

Q1. What are the three types of due diligence?

The three main types of due diligence are financial, legal, and operational. Financial checks assess fiscal health, legal reviews ensure compliance, and operational evaluations examine business efficiency and risks.

Q2. What is another name for due diligence?

Another name for due diligence is background investigation or pre-investment review. It refers to the thorough assessment of a business or asset to verify facts and identify potential risks before finalizing a deal.

Q3. How long does due diligence take?

Due diligence typically takes 30 to 60 days, depending on the complexity of the transaction and the scope of the review. Larger or more intricate deals may require additional time for thorough analysis.