Due diligence services can quietly save investors from making decisions they later regret. Most failed investments don’t collapse overnight they slowly unravel because something important was overlooked at the beginning.

If you’re thinking about buying a business, investing in a growing company, or entering into a partnership, this conversation matters. Because before you sign anything, you need to know what you’re really stepping into.

Why Do Smart Investors Still Make Costly Mistakes?

Here’s the truth: even experienced investors get it wrong sometimes. Not because they’re careless but because they trusted numbers or promises without digging deeper.

A company might show strong profits.

Sales might look impressive.

Growth might seem unstoppable.

But when you look closely, you may find:

- Revenue coming from just one major client.

- Delayed vendor payments making cash flow look better than it is.

- Loans that weren’t clearly explained.

- Tax issues still under review.

- Contracts with risky clauses.

None of this is obvious at first glance. That’s why many investors now rely on due diligence services in India before moving forward with a deal especially when entering unfamiliar markets.

Looking Beyond the Profit Figure

One of the biggest misconceptions in investing is this: “If profits look good, the business must be healthy.

That’s not always true.

What Financial Due Diligence Really Means

Financial due diligence is basically a deep financial health check. It’s not about mistrusting the seller — it’s about understanding the real picture.

It helps answer questions like:

- Are these profits recurring or one-time gains?

- Is cash actually coming in regularly?

- Are there unpaid liabilities hiding in the background?

- Is the company dependent on borrowed funds to survive?

Sometimes, the numbers aren’t wrong they’re just incomplete.

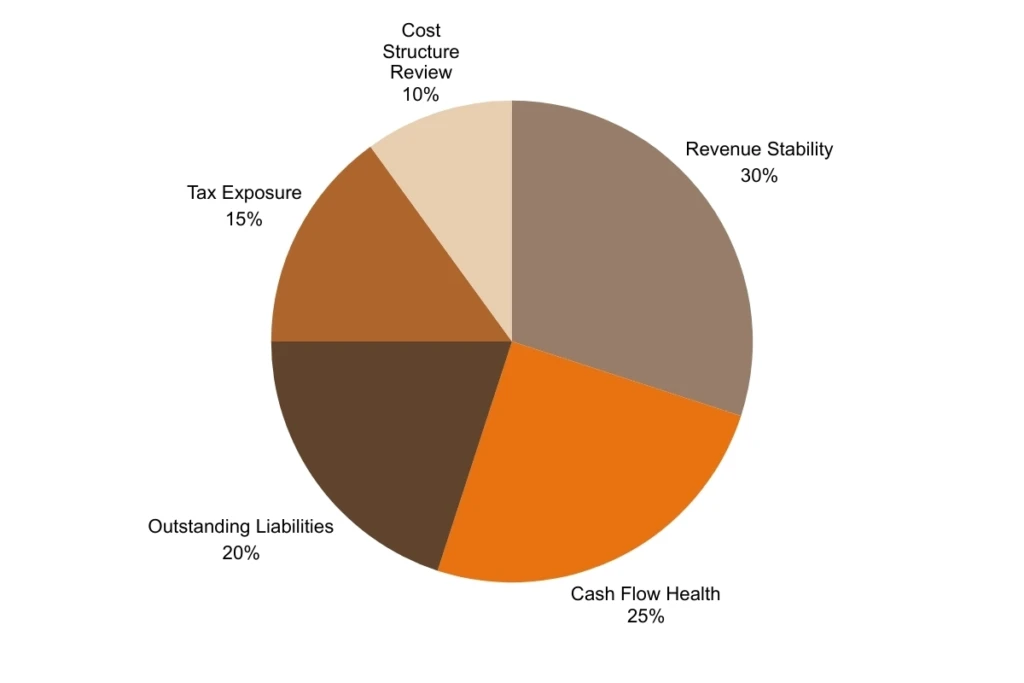

Pie Chart: What Gets Reviewed Most Often

You’ll notice that cash flow gets almost as much attention as revenue. That’s because a company can show profit and still struggle to pay its bills.

Finding the Problems No One Mentions

Not all risks are written clearly in financial statements.

Some are hidden inside contracts.

Some sit quietly in pending legal matters.

Some show up in operational inefficiencies.

Professional due diligence consulting services look at areas many investors don’t think to check.

For example:

- Are there ongoing legal disputes?

- Does one supplier control most of the inventory?

- Are customer contracts secure or short-term?

- Is compliance up to date with local regulations?

Even small issues can turn into major costs later.

A Simple View of the Process

Collect Documents

↓

Review Financial & Legal Records

↓

Identify Red Flags

↓

Adjust Financial Position

↓

Present Clear Risk Summary

↓

Make an Informed Decision

It’s not complicated but it is detailed. And that detail makes all the difference.

Paying the Right Price — Not an Emotional Price

Investments often become emotional. Especially when a business looks promising.

But excitement can lead to overpayment.

Without proper review, buyers might:

- Accept inflated projections.

- Ignore short-term revenue spikes.

- Miss hidden debt obligations.

Here’s how things change when proper due diligence is done:

Before vs After Due Diligence

| Area | Without Review | With Review |

| Business Valuation | Based on forecast | Based on verified performance |

| Profit Numbers | Taken as reported | Adjusted realistically |

| Liabilities | Partially visible | Fully mapped |

| Negotiation | Limited leverage | Strong position |

Many investors renegotiate deals after findings are presented. Some restructure payment terms. Some even decide to step away.

And walking away from the wrong deal is sometimes the smartest move.

Building Confidence Not Just Protection

Due diligence isn’t only about avoiding loss. It’s also about entering a deal with confidence.

When the review is complete:

- Investors understand the business clearly.

- Stakeholders feel secure.

- Banks and lenders are more comfortable.

- Post-deal surprises are minimized.

Firms providing due diligence services in India also understand local tax rules, compliance requirements, and regulatory expectations. That local insight can be extremely valuable, especially for overseas investors.

Confidence doesn’t come from hope. It comes from clarity.

Mini Blog: What Really Happens If You Skip Due Diligence?

It might feel like saving time or reducing cost. But let’s look at what actually happens.

A. Immediate Financial Impact

Without proper review, you might:

- Discover unpaid liabilities after acquisition.

- Face unexpected tax penalties.

- Realize projected revenue was temporary.

- Overpay by 15–25%.

Those are direct financial hits.

B. Long-Term Damage

The bigger problems often come later:

- Legal complications.

- Loss of investor trust.

- Operational instability.

- Reputation concerns.

Fixing these issues after closing the deal is stressful, expensive, and time-consuming.

Most experienced investors will tell you prevention is far cheaper than correction.

A Practical Way to Think About It

Imagine buying a property without checking the foundation. It may look beautiful on the outside. But structural issues can cost far more than the initial inspection.

The same logic applies to business investments.

Due diligence is not about being overly cautious. It’s about being responsible with capital.

Final Thoughts

Every investment involves risk. That will never change. But unmanaged risk is what causes real damage.

Taking time to properly review financial records, legal exposure, operational systems, and compliance status can protect both your money and your reputation.

Working with experienced professionals who also understand broader accounting services in India ensures the numbers are reliable and aligned with regulatory standards.

At the end of the day, successful investors don’t rely on assumptions.

They ask questions.

They verify details.

And they make decisions based on facts — not hope.

Ready to invest with clarity and confidence?

At DGA Global, we help you make informed decisions through detailed financial review, risk assessment, and professional due diligence support. Whether you’re planning an acquisition, partnership, or strategic investment, our experts are here to guide you every step of the way.

Get in touch with DGA Global today and make your next investment decision with confidence.

FAQs

Q1. Why is due diligence important in investing?

Due diligence is important because it helps you clearly see where your money is going. It checks the facts, looks for possible risks, and makes sure the business is as strong as it claims to be. Without it, you might invest based on guesswork and face losses later.

Q2. What are the benefits of due diligence?

Due diligence helps you avoid financial surprises by finding hidden problems early. It shows whether the business is priced fairly and financially stable. This way, you can make your decision with confidence instead of uncertainty.

Q3. What is the main objective of due diligence?

The main objective of due diligence is to carefully review a business before finalizing any deal. It helps confirm that all information is correct and that there are no hidden risks. Simply put, it protects you from making a wrong investment decision.