Investors step into opportunities with hopes of strong returns, but without proper checks, they risk losing millions. This is where due diligence services come into play acting as a financial shield that helps investors separate promising opportunities from dangerous traps. Whether it’s a merger, acquisition, or new venture, due diligence ensures decisions are based on facts, not assumptions.

Why Investors Lose Big Without Due Diligence

Before understanding how due diligence saves investors, it’s important to see why so many face losses when they skip this step. In most cases, the risks are not obvious at first glance, but they become costly surprises later.

Common reasons investors lose money:

- Overlooking hidden liabilities such as unpaid taxes or debts

A company may look profitable on paper, but hidden obligations like unpaid vendor dues, bank loans, or tax defaults—can eat into future cash flow. Investors often inherit these problems without realizing it. - Misjudging the true market valuation of the company

Without a proper financial review, investors may pay far more than what the business is really worth. Overvaluation leads to poor returns and long recovery times. - Ignoring compliance requirements and legal risks

Many businesses fail to follow industry-specific regulations or have ongoing litigations. Such oversights can cause penalties, business shutdowns, or even legal battles for the investor. - Falling for manipulated or inflated financial statements

Some businesses exaggerate revenues, hide expenses, or misreport assets to look stronger than they are. Without due diligence, investors may trust these numbers and commit capital blindly. - Not assessing industry or market uncertainties

A business might appear stable but could be in a declining industry or facing disruptive competition. Market risks like these can reduce long-term profitability and make investments unsustainable.

In short, skipping due diligence is like buying a house without checking for cracks in the foundation. The risk may not be visible at first, but it can collapse into huge losses later.

What Due Diligence Really Covers

Due diligence is not just about reviewing numbers—it’s a multi-layered investigation that digs into every aspect of a business. Each layer uncovers insights that protect investors from potential pitfalls.

| Type of Due Diligence | Focus Area | Why It Protects Investors |

| Financial | Audits, statements, cash flow | Ensures investors pay the right value. |

| Legal | Contracts, licenses, litigations | Prevents lawsuits or regulatory troubles. |

| Operational | Processes, technology, workforce | Confirms if the business can scale. |

| Commercial | Market share, competition | Shows growth potential and risks. |

| Tax | Liabilities, filings, compliance | Saves investors from hidden penalties. |

Breaking it down further:

- Financial Due Diligence – Reviews cash flow, debts, and profits to ensure the company’s value is accurate and not overstated.

- Legal Due Diligence – Checks contracts, licenses, and disputes so investors don’t face hidden lawsuits or compliance issues.

- Operational Due Diligence – Looks at daily processes, technology, and workforce to confirm the business can run and grow smoothly.

- Commercial Due Diligence – Studies market share, competition, and customer base to verify growth potential is realistic.

- Tax Due Diligence – Identifies tax liabilities and ensures compliance so investors don’t inherit penalties or risks.

Each type of due diligence acts as a safety filter that prevents investors from stepping into unexpected losses.

The Standard Due Diligence Process

The due diligence process follows a step-by-step approach to ensure every detail of the target business is carefully reviewed before an investment is made.

Step 1: Pre-Assessment

The process begins by defining the scope, objectives, and areas of focus. This ensures the investigation is tailored to the investor’s needs.

Step 2: Data Collection

Relevant documents such as financial records, contracts, legal filings, and market reports are gathered for analysis.

Step 3: Verification

All collected data is cross-checked for accuracy and authenticity to rule out misrepresentations or false reporting.

Step 4: Risk Analysis

This stage identifies potential red flags such as unpaid debts, lawsuits, compliance gaps, or operational weaknesses.

Step 5: Reporting

The findings are compiled into a detailed report with actionable insights, highlighting both risks and opportunities.

Step 6: Decision-Making

Based on the report, investors make an informed choice—whether to proceed, renegotiate, or walk away.

How Due Diligence Services Protect Investors from Losses

The core purpose of due diligence is to uncover risks before they turn into costly mistakes. For investors, this process works like a safety net that ensures every decision is supported by verified facts rather than assumptions.

Here’s how it protects against major losses:

- Uncovering Hidden Liabilities

By reviewing debts, pending litigations, and tax obligations, due diligence ensures investors don’t inherit financial baggage that reduces future profitability. - Validating Business Value

It prevents investors from overpaying by confirming whether the financial statements and projections truly reflect the company’s worth. - Ensuring Legal Compliance

A detailed review of licenses, contracts, and regulatory requirements protects investors from potential lawsuits or penalties. - Assessing Long-Term Viability

Beyond numbers, due diligence looks at operations, processes, and market conditions to confirm whether the business model is sustainable. - Building Investor Confidence

With all risks identified, investors can move forward with clarity and negotiate deals from a position of strength.

In short, due diligence services don’t just analyze documents—they safeguard capital, reduce uncertainty, and give investors the confidence to pursue opportunities with lower risk.

Why Global Investors Choose Due Diligence Services in India

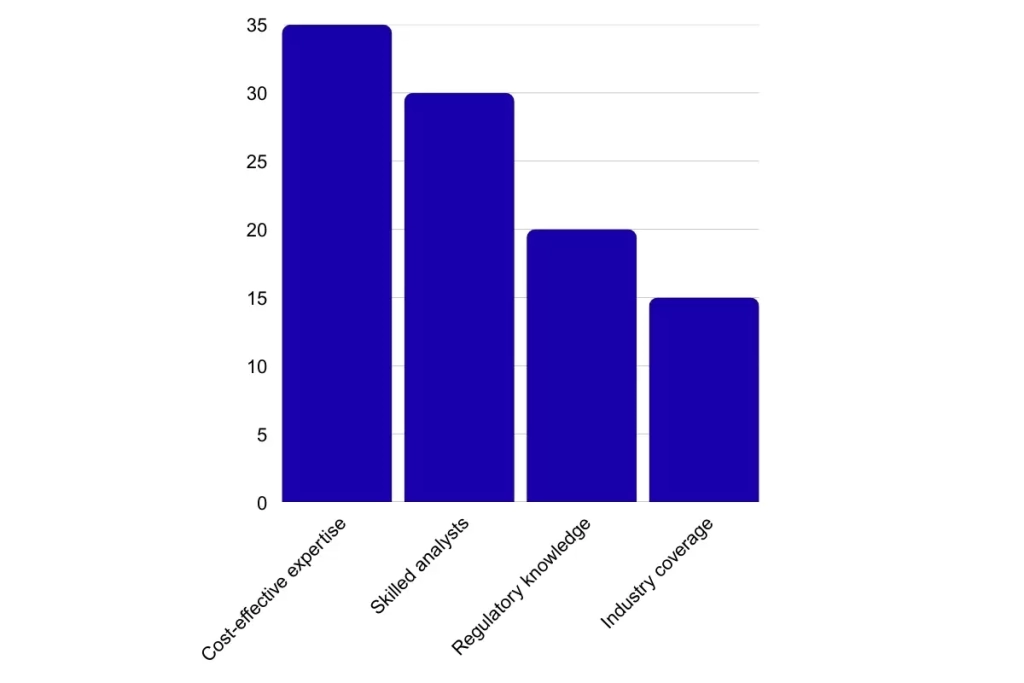

International investors increasingly prefer due diligence services in India because of affordability, expertise, and global compliance knowledge, making it a trusted hub for cost-effective yet reliable investment assessments.

This makes India a trusted hub for investors seeking reliable due diligence before major decisions.

Final Thoughts

Investing has risks, but due diligence helps find hidden problems and shows the real state of a business.Paired with reliable accounting services in India, investors can make smarter decisions, reduce risk, and move forward with confidence. Careful analysis and expert guidance turn risks into opportunities, helping investors make safer, smarter decisions.

FAQs

Q1. Who pays for due diligence?

The cost of due diligence is usually borne by the investor or the party conducting the review. In some cases, it may be negotiated as part of the deal, depending on the agreement between the buyer and the seller.

Q2. Who to hire for due diligence?

Investors usually hire experienced professionals such as financial analysts, accountants, auditors, or specialized due diligence firms. Choosing experts with knowledge of the specific industry ensures accurate and reliable insights.

Q3. Who prepares a due diligence report?

A due diligence report is prepared by professionals such as financial analysts, auditors, or specialized due diligence firms. They compile and analyze all relevant financial, legal, and operational information to provide a comprehensive assessment for investors.