Outsourcing accounting services in India has become a strategic choice for businesses worldwide looking to optimize costs while maintaining high-quality financial management. With experienced professionals, advanced technology, and cost-effective operations, India offers a compelling solution for companies seeking smarter accounting solutions. Offshoring not only reduces expenses but also provides access to a global talent pool, enhancing efficiency and financial insights.

In this blog, we explore how offshoring accounting to India can cut costs by more than 50% while delivering top-notch financial services.

Cost Efficiency Through Skilled Talent

One of the main drivers behind offshoring accounting to India is the significant cost advantage. Indian accounting professionals offer high expertise at a fraction of the cost compared to Western countries.

Key Factors Contributing to Cost Savings

- Lower labor costs without compromising quality.

- Flexible scaling options for small and large teams.

- Reduced infrastructure and technology expenses.

By leveraging accounting services in India, businesses can reallocate saved resources toward growth initiatives or strategic projects, making operations leaner and more agile.

Access to Advanced Technology and Automation

Offshoring is not just about labor cost reduction it also provides access to state-of-the-art technology. Indian accounting firms utilize automation, cloud platforms, and AI-driven tools to streamline processes.

Technology Integration in Offshoring Accounting

| Technology | Function | Business Benefit |

| Cloud Accounting | Real-time access to financial data | Transparency & faster decision-making |

| Automation Tools | Invoicing, payroll, reconciliations | Reduces manual errors & time |

| AI & Analytics | Forecasting & insights | Better financial planning |

| Collaboration Platforms | Communication & file sharing | Seamless cross-border collaboration |

This integration ensures that businesses not only save money but also enhance efficiency and accuracy, a combination that’s critical for sustaining growth in competitive markets.

Flexibility and Scalability for Businesses

Offshoring accounting allows businesses to scale services according to their needs. Small businesses, mid-sized companies, and large enterprises can all benefit from tailored solutions.

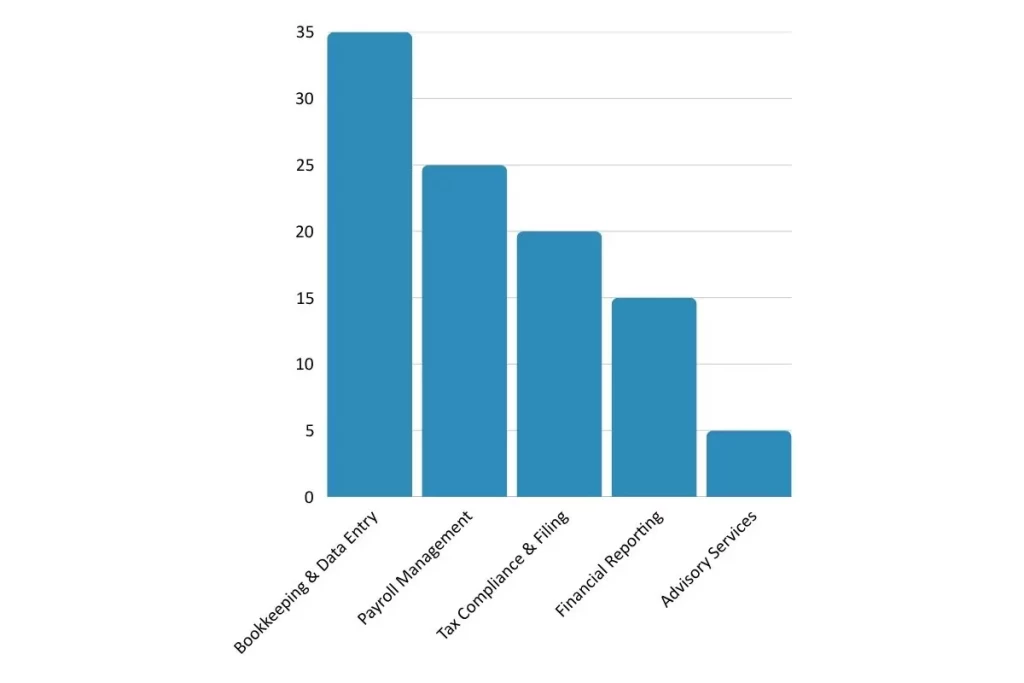

Typical Allocation of Offshored Accounting Services

This flexibility is especially beneficial for businesses experiencing seasonal fluctuations or rapid growth. Moreover, it allows companies to access best virtual CFO services without committing to full-time local hires, making offshoring a strategic financial decision.

Strategic Advisory for Better Decision-Making

Offshoring accounting to India goes beyond bookkeeping—it provides strategic insights through experienced advisory teams. Companies can now access virtual CFO expertise remotely, enabling smarter financial decisions.

Key Benefits of Offshoring Advisory Services

- Financial Planning: Real-time cash flow analysis and forecasting.

- Budget Optimization: Data-driven recommendations to cut costs and improve ROI.

- Risk Management: Proactive identification of potential financial pitfalls.

- Virtual CFO Support: Small and mid-sized businesses gain insights normally available only to large enterprises.

This approach ensures businesses benefit from virtual CFO small business services without incurring the cost of an in-house CFO, enhancing both profitability and operational efficiency.

Enhanced Compliance and Reduced Operational Risks

Regulatory compliance is a major concern for global businesses. Offshoring to India provides access to professionals who are well-versed in international accounting standards and local tax regulations, reducing risk exposure.

Offshoring Benefits in Compliance and Risk Management

| Area | Challenge | Offshoring Advantage |

| Tax Compliance | Complex local and international laws | Experienced teams ensure accurate filing |

| Audit Readiness | Maintaining records for audits | Real-time reporting and documentation |

| Data Security | Risk of errors or breaches | Secure cloud systems & encrypted processes |

| Regulatory Updates | Frequent changes in laws | Advisory teams monitor & update clients proactively |

With these measures, businesses can focus on growth while minimizing operational disruptions, ensuring accuracy, reliability, and regulatory compliance at all times.

Conclusion: Offshoring as a Strategic Growth Lever

Offshoring accounting to India offers more than just cost savings—it provides efficiency, access to top talent, advanced technology, and strategic advisory. Businesses can reduce expenses by 50%+, gain flexibility, and leverage outsourcing for small businesses to focus on growth and innovation.

By integrating global expertise with scalable solutions, companies can transform their accounting operations from a cost center into a strategic driver of business success.

FAQs

Q1. How much cheaper is it to outsource to India?

Outsourcing to India is significantly more cost-effective than hiring in-house teams. Businesses save on labor and operational costs while accessing skilled professionals and advanced technology.

Q2. What are the benefits of offshoring to India?

Offshoring to India offers cost savings, access to skilled professionals, and advanced technology. It also ensures efficiency, scalability, and reliable financial management.

Q3. How is the reduction in costs possible through outsourcing?

Cost reduction is achieved through lower labor and operational expenses, combined with efficient processes and advanced technology. Outsourcing also eliminates the need for in-house infrastructure and overheads.