Setting up accounting for small business from scratch is one of the smartest moves a founder can make early on. Whether you’re launching a startup or formalizing finances for an existing venture, a solid accounting setup helps you track cash flow, stay compliant, and make confident business decisions without confusion or chaos.

This guide walks you step by step through the complete accounting setup process in a way that’s practical, easy to understand, and built for long-term growth.

Understand Why Accounting Is Non-Negotiable for Small Businesses

Many small businesses delay accounting until tax season—or worse, until problems arise. But accounting is not just about compliance; it’s about control.

Why accounting matters from day one:

- Gives clear visibility into income, expenses, and profits

- Helps avoid cash-flow surprises

- Ensures tax and regulatory compliance

- Builds credibility with banks, investors, and partners

Without a structured accounting system, decision-making becomes guesswork rather than strategy.

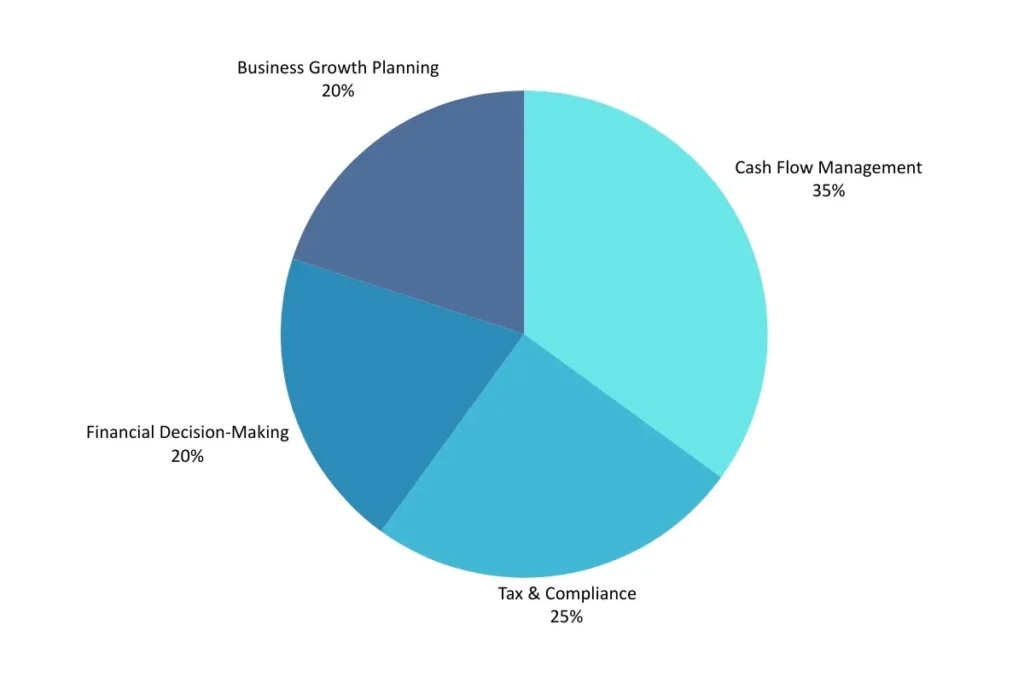

Why Small Businesses Need Accounting

This clearly shows that accounting supports far more than just tax filing.

Choose the Right Business Structure and Accounting Method

Before recording a single transaction, your accounting setup must align with how your business operates legally and financially.

Step 1: Select a Business Structure

- Sole Proprietorship

- Partnership

- Private Limited Company

- LLP

Each structure has different compliance and reporting requirements.

Step 2: Decide the Accounting Method

| Accounting Method | Best For | Key Benefit |

| Cash Basis | Small service businesses | Simple & easy tracking |

| Accrual Basis | Growing or funded businesses | Accurate financial position |

Choosing the right method ensures consistency and avoids future rework as your business scales.

Set Up a Business Bank Account and Chart of Accounts

Mixing personal and business finances is one of the most common mistakes small businesses make.

What you should do immediately:

- Open a dedicated business bank account

- Set up payment gateways linked only to business income

- Separate owner withdrawals from expenses

Build a Chart of Accounts

A chart of accounts organizes your financial data into categories such as:

- Assets (cash, receivables)

- Liabilities (loans, payables)

- Income

- Expenses

Basic Accounting Setup Flow

This flow ensures your accounting foundation is structured and scalable.

Select the Right Accounting Software and Tools

Manual accounting may work initially, but it quickly becomes inefficient and error-prone.

What to look for in accounting software:

- Automated invoicing and expense tracking

- GST and tax compliance features

- Bank reconciliation

- Cloud accessibility

Many small businesses combine software with professional support through a bookkeeping and tax service to ensure accuracy, compliance, and timely reporting without internal overhead.

The right tools reduce manual effort and free founders to focus on growth rather than spreadsheets

Maintain Daily Bookkeeping and Monthly Financial Reviews

Accounting works best when it’s consistent, not reactive.

Daily bookkeeping should include:

- Recording all income and expenses

- Uploading bills and invoices

- Tracking receivables and payables

Monthly financial review checklist:

- Bank reconciliation

- Profit & Loss statement review

- Expense analysis

- Cash flow monitoring

Table: Daily vs Monthly Accounting Tasks

| Daily Tasks | Monthly Tasks |

| Record transactions | Reconcile bank accounts |

| Upload invoices | Review P&L |

| Track expenses | Compliance checks |

| Update receivables | Financial insights |

Regular reviews help identify issues early and keep finances predictable.

Should Small Businesses Handle Accounting In-House or Outsource It?

When setting up accounting from scratch, small business owners often struggle to decide whether to manage finances internally or rely on external experts. Let’s break this down using different perspectives.

What Are the Pros and Cons of In-House Accounting?

In-house accounting can work when:

- The business has very low transaction volume

- Daily financial visibility is required

- The owner prefers direct control over records

But it also comes with challenges:

- Hiring and training costs

- Limited expertise in tax and compliance

- Higher risk of errors as complexity increases

This model is usually suitable only at an early stage.

How Does Outsourced Accounting Simplify Financial Management?

Outsourced accounting focuses on expertise and efficiency.

Instead of building an internal team, businesses gain access to experienced professionals who manage bookkeeping, reporting, and compliance.

Key advantages include:

- Reduced operational costs

- Access to industry best practices

- Better accuracy and compliance

- Easy scalability as the business grows

This approach allows founders to focus on growth rather than financial administration.

Is a Hybrid Accounting Model a Smarter Long-Term Solution?

A hybrid accounting model combines basic internal record-keeping with expert external oversight.

How it works in practice:

- In-house team handles daily data entry

- External professionals review reports

- Compliance and filings are managed by experts

This model offers flexibility, cost control, and professional accuracy – making it a popular choice for scaling small businesses.

Stay Compliant With Taxes and Regulatory Requirements

Compliance is not optional – especially for growing small businesses.

Key compliance areas to manage:

- GST filings

- Income tax returns

- TDS compliance

- Statutory reporting

Missing deadlines or misreporting can lead to penalties and operational disruptions. Many businesses leverage expert support or Global outsourcing services to manage compliance efficiently while maintaining data security and regulatory accuracy.

Outsourced accounting brings expertise, cost efficiency, and scalability without the burden of hiring an in-house team.

Conclusion: Build a Strong Financial Foundation From Day One

Setting up accounting correctly from scratch is not just a back-office task it’s a growth strategy. From choosing the right structure and tools to maintaining compliance and financial clarity, each step builds confidence and control.

As your business evolves, partnering with professionals who understand accounting services for a small business can help you stay compliant, scalable, and financially healthy without unnecessary complexity.

A strong accounting foundation today leads to smarter decisions and sustainable growth tomorrow.

FAQs

Q1. How to start accounting for a small business?

To start accounting for a small business, first open a separate business bank account and choose an accounting method (cash or accrual). Set up basic accounting software to record income and expenses regularly. Review financial reports monthly to stay compliant and financially organized.

Q2. How to manage accounting for a small business?

To manage accounting for a small business, record all income and expenses consistently and keep business finances separate from personal ones. Use accounting software to track transactions, invoices, and taxes accurately. Review financial reports regularly to monitor cash flow and ensure compliance.

Q3. What is the difference between bookkeeping and accounting?

Bookkeeping focuses on recording daily financial transactions such as income, expenses, and invoices. Accounting goes a step further by analyzing, summarizing, and interpreting this financial data. In short, bookkeeping is about recording data, while accounting is about using that data to make decisions.