In recent years, virtual accounting firms in India have emerged as a powerful alternative to traditional CPA firms, especially for businesses operating in the UK, US, Canada, and Australia. From startups to mid-size enterprises, companies worldwide are increasingly choosing Indian virtual firms to streamline operations, lower costs, and gain access to expert financial guidance.

This shift is not just about outsourcing, it’s a complete transformation in how global businesses handle accounting, compliance, and strategic finance. Let’s break down why this disruption is happening and what it means for the future of financial services.

What Makes Virtual Accounting Firms in India So Scalable and Cost-Effective

Traditional CPA services often come with limitations high hourly rates, local availability, limited tech support, and rigid engagement models. In contrast, virtual accounting firms in India provide a flexible, on-demand, and highly cost-effective solution.

Why They’re More Scalable:

- Elastic workforce: Teams scale up or down depending on business needs (like tax season, audits, or funding rounds).

- Remote-first infrastructure: Operates seamlessly across time zones using cloud accounting platforms.

- Specialized teams: Access to niche experts GST, US GAAP, IFRS, valuation, transfer pricing, and more.

Why They’re More Cost-Effective:

- Lower labor and infrastructure costs in India.

- Monthly retainers vs. unpredictable hourly billing.

- Bundled services (accounting + tax + advisory) under one roof.

Why Global Startups Prefer Virtual Accounting Firms in India Over Traditional CPAs

Startups today need more than just number crunchers they need tech-savvy partners who can keep up with their fast pace. Here’s why virtual accounting firms in India are becoming the preferred choice for startups around the world:

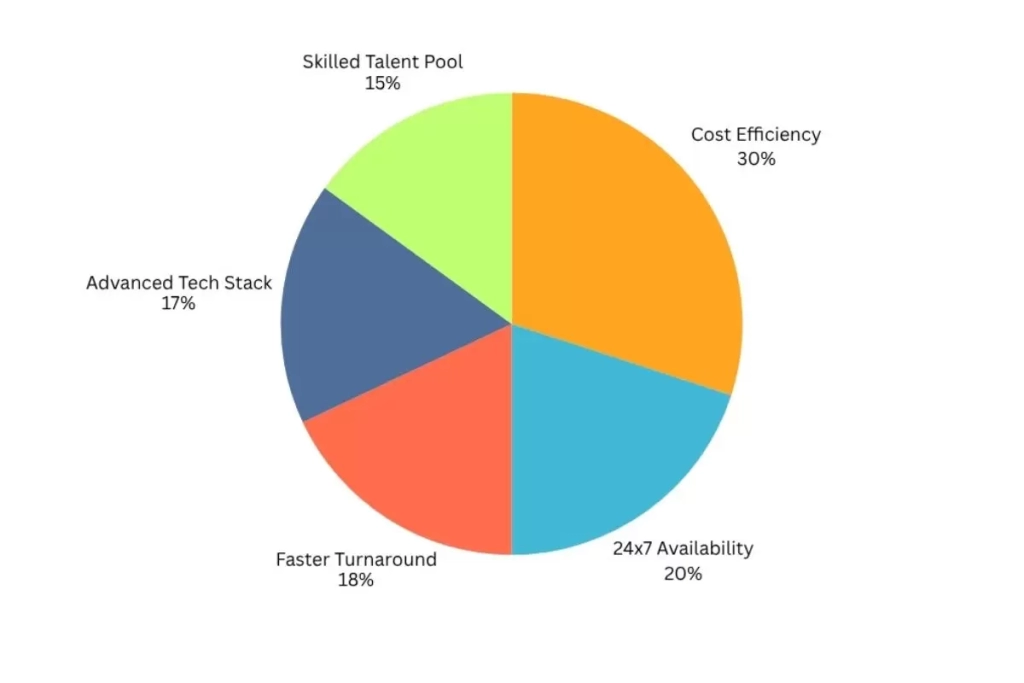

Top Reasons Global Startups Choose Virtual Accounting Firms in India:

- Cost Efficiency – Huge savings vs. US/UK-based CPA firms

- 24×7 Availability – Always-on support across time zones

- Faster Turnaround – Quick response and reporting

- Advanced Tech Stack – Seamless cloud integration

- Skilled Talent Pool – Top CA/CFO talent, globally aware

This clearly illustrates why the traditional model is falling out of favor it’s just not agile enough for today’s fast-moving global business environment.

How the Best Virtual CFO Services Empower Small Businesses to Grow Smarter

Accounting alone isn’t enough. Small businesses today need financial strategic guidance something full-time CFOs provide, but at a high cost.

This is where the best virtual CFO services come in. Offered by Indian firms, these services help small businesses across the UK, US, and Canada:

Strategic Benefits

- Cash Flow Planning

- Helps predict cash shortages or surpluses in advance

- Allows businesses to manage vendor payments, payroll, and investments proactively

- Helps predict cash shortages or surpluses in advance

- Financial Forecasting

- Uses real-time financial data to project future revenues and expenses

- Supports informed decision-making for scaling, hiring, or budgeting

- Uses real-time financial data to project future revenues and expenses

- Investor Readiness

- Prepares audit-ready financials, pitch decks, and cap tables

- Ensures transparency and compliance for funding rounds or acquisitions

- Prepares audit-ready financials, pitch decks, and cap tables

- KPI Reporting

- Tracks key business metrics like revenue growth, churn, or margins

- Offers visual, real-time dashboards for faster and smarter decisions

- Tracks key business metrics like revenue growth, churn, or margins

Why Choose Virtual CFO Services in Gurgaon?

Gurgaon is quickly becoming a virtual CFO hub, with firms offering US GAAP, IFRS, and international taxation knowledge. With experienced professionals (many ex–Big Four), it’s no surprise that businesses globally are trusting virtual CFO services in Gurgaon for CFO-level thinking at a fraction of the cost.

Whether you’re a Canada-based eCommerce startup or an Australian fintech firm, the Indian virtual CFO model helps you grow smarter without breaking the bank.

Are Virtual Accounting Firms the Future of Global Finance Teams?

Absolutely. The traditional CPA model, with its high costs and slow cycles, is no longer enough for modern businesses. Virtual accounting firms are rewriting the playbook:

- Real-time collaboration

- Global compliance at scale

- Reduced overheads

- On-demand financial expertise

From basic bookkeeping to high-level strategic advisory, these firms act as remote finance teams integrated, tech-savvy, and globally aligned.

They’re not just a cost-cutting tool, they’re a competitive advantage.

Conclusion

Running a business today means staying quick on your feet. Whether you’re a startup or a virtual CFO small business, working with a virtual accounting firm in India can help you manage your finances without the stress. You get expert help, clear reports, and up-to-date numbers all without needing a full-time team.

More businesses are moving away from traditional accounting. With India leading the way, it’s now easier to get smart, reliable support from anywhere. If you’re ready to make finance simpler, going virtual might be the best step forward.

FAQs

Q1. How does virtualization impact the accounting profession?

Virtualization has made accounting faster, more flexible, and fully remote. It allows firms to use cloud software, automate tasks, and serve clients globally without physical presence. This shift also lowers costs and improves real-time decision-making.

Q2. What does the virtual accountant or bookkeeper do?

A virtual accountant or bookkeeper manages transactions, invoicing, and reconciliations remotely, keeping your books accurate and up to date.

Q3. What is the difference between a CFO and a virtual CFO?

A CFO is a full-time, in-house executive managing a company’s finances, while a virtual CFO offers similar expertise remotely, often part-time or on-demand, at a lower cost.