Offshore audit services are no longer just an outsourcing option. They’ve evolved into strategic enablers for finance teams across the globe. Whether you’re a startup trying to scale or a large enterprise aiming for efficiency, partnering with offshore audit experts can redefine how your financial backbone operates.

In this blog, we will uncover what offshore audit services mean, why they’re gaining momentum, the role of audit firm services in scalability, the rising dominance of an audit offshoring firm in India, and bust some myths around this silent yet powerful partner.

What Are Offshore Audit Services & Why Are They Gaining Global Momentum?

Offshore audit services refer to delegating audit and accounting functions to specialized firms located outside the company’s home country. These firms handle core auditing tasks—financial audits, compliance reviews, internal controls, and risk assessments—at a fraction of the cost, while maintaining global standards.

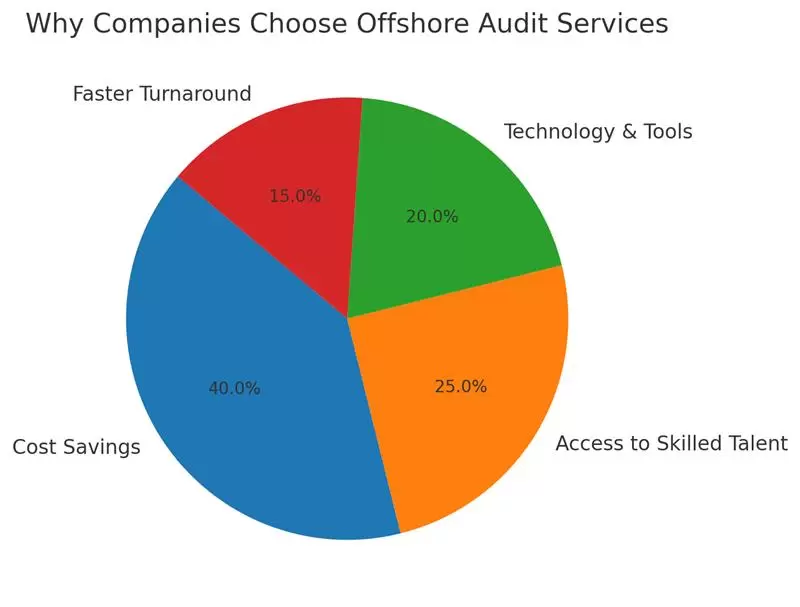

Why They’re Gaining Momentum Globally

- Cost Advantage – Companies save up to 50–60% in audit costs compared to in-house or local firms.

- Talent Access – Offshore hubs like India bring in highly skilled auditors trained in IFRS, GAAP, and international tax laws.

- Scalability – Offshore partners provide flexibility to expand or reduce team size based on workload.

- Technology-Driven – Modern offshore audit firms leverage AI, automation, and secure cloud platforms.

- Global Compliance – Seamless alignment with US, UK, and EU compliance frameworks.

Key Audit Firm Services That Enable Scalable Finance for Startups & Enterprises

The role of audit firm services goes far beyond basic financial audits. They provide holistic support that helps finance teams scale without bottlenecks.

Core Services Offered by Offshore Audit Partners

- Financial Statement Audits – Ensuring Transparency and Investor Trust

Offshore auditors verify accuracy and compliance of financial statements, helping businesses build credibility with investors and regulators. - Internal Audits – Strengthening Internal Controls and Risk Management

They review processes and controls to detect weaknesses, reduce risks, and improve overall efficiency in financial operations. - Tax Compliance Audits – Minimizing Risks of Penalties and Ensuring Cross-Border Efficiency

Offshore experts ensure accurate tax filings, compliance with global tax laws, and protection against costly penalties. - IT & Systems Audit – Reviewing Cybersecurity, ERP Systems, and Automation Frameworks

These audits secure financial data, review ERP systems, and optimize digital workflows for better accuracy and compliance. - Forensic Audits – Detecting Fraud, Misstatements, and Irregularities

Offshore partners investigate fraud or irregularities using forensic techniques, providing evidence for compliance and legal needs.

How Audit Firm Services Support Different Business Stages

| Business Stage | Key Services Needed | Benefits Provided |

| Startup | Financial audits, compliance setup | Builds investor trust, regulatory safety |

| Scaling Enterprise | Internal audits, IT audits, tax planning | Supports global expansion, lowers risks |

| Large Corporation | Forensic audits, strategic compliance reviews | Protects against fraud & reputational loss |

Why an Audit Offshoring Firm in India Is the Go-To Partner for US/UK Companies

For US and UK businesses, partnering with an audit offshoring firm in India is no longer just about cost savings—it’s about gaining a strategic advantage. Here’s why companies increasingly turn to Indian partners:

1. Significant Cost Advantage

- Lower Operational Costs – Hiring offshore audit professionals in India is much more cost-effective than maintaining in-house teams.

- Flexible Pricing Models – Firms offer project-based, hourly, or retainer pricing, giving clients budget control.

2. Access to Skilled Talent Pool

- Globally Qualified Professionals – Many auditors in India are ACCA, CPA, and CA certified, ensuring global compliance expertise.

- Specialized Knowledge – Teams are trained in niche areas such as forensic audits, IT audits, and cross-border tax audits.

3. Advanced Technology & Infrastructure

- Cloud-Based Tools – Secure platforms ensure real-time data sharing and collaboration.

- AI & Automation Support – Offshore firms leverage modern audit tools, reducing manual errors and improving efficiency.

4. Faster Turnaround Times

- Time-Zone Advantage – With India’s time difference, audit work progresses even after US/UK office hours.

- Round-the-Clock Delivery – Dedicated teams ensure quicker completion of audits and reporting.

5. Strong Compliance & Risk Management

- Global Standards Alignment – Offshore firms follow IFRS, US GAAP, and UK standards.

- Risk Mitigation – Strict internal controls and quality checks minimize errors and fraud risks.

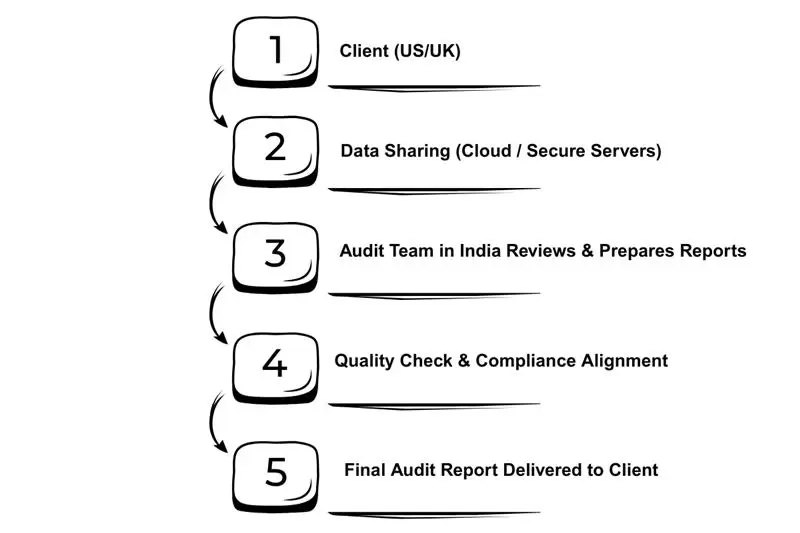

How Audit Offshoring from India Works

Common Misconceptions About Offshore Audit Services (And What’s Actually True)

While offshore auditing has gained momentum, some misconceptions still prevent businesses from leveraging it fully. Let’s bust them:

Misconception 1: Offshore = Low Quality

Truth: Offshore audit firms follow international standards (IFRS, GAAP, SOX) and often deliver quality on par with Big 4 firms.

Misconception 2: Offshore Means Data Is at Risk

Truth: Offshore partners use advanced encryption, GDPR compliance, and secure servers to safeguard client data.

Misconception 3: Offshore Is Only for Big Companies

Truth: Startups and SMEs also benefit significantly, with services tailored for their budgets and compliance needs.

Misconception 4: Offshore Teams Lack Industry Knowledge

Truth: Offshore auditors specialize across industries—IT, manufacturing, healthcare, e-commerce—bringing domain expertise.

Myths vs. Realities in Offshore Audit Services

| Myth | Reality |

| Offshore = Low Quality | Offshore firms meet global standards & quality benchmarks |

| Data Security Is Weak | GDPR, ISO, and AI-driven security frameworks are followed |

| Only for Big Companies | Scalable packages for startups and SMEs available |

| No Industry Specialization | Dedicated auditors with sector-specific expertise |

Conclusion: Offshore Audit Services – The Future of Scalable Finance

The rise of offshore audit services signals a new era in financial scalability. From reducing costs to unlocking global expertise, offshore partners act as silent enablers for finance teams that want to scale smartly.

By leveraging audit firm services and the unmatched value offered by an audit offshoring firm in India, US and UK companies are setting stronger, more resilient foundations for their financial operations.

As global business evolves, the demand for off shore accounting will only grow positioning offshore audit partners not just as service providers but as strategic allies.

FAQs

Q1. What is the main goal of an audit?

Ans :- The main goal of an audit is to provide an independent evaluation of a company’s financial records, ensuring accuracy, compliance, and transparency. At DGA Global, audits are designed to build trust, reduce risks, and strengthen decision-making for businesses.

Q2. What are the objectives of auditing?

Ans :- The objectives of auditing are to verify the accuracy of financial statements, ensure compliance with regulations, and detect any errors or fraud. DGA Global focuses on these objectives to enhance transparency, build investor confidence, and support better business governance.

Q3. Who needs to submit financial statements?Ans :- Financial statements need to be submitted by companies, partnerships, and other registered entities to comply with legal, tax, and regulatory requirements. DGA Global helps businesses of all sizes prepare and present accurate statements that meet global compliance standards.