The Hidden Link Between Auditing Services and Tax Accuracy Services and Tax Accuracy

Auditing services play a far deeper role in business success than most companies realize. While audits are often viewed as a compliance requirement, their real value lies in how they strengthen tax accuracy, reduce financial risks, and improve long-term decision-making. For businesses operating in complex tax environments like the US and UK, a well-structured audit […]

5 Ways Audit and Accounting Services Are Evolving in 2025

If you compare how things worked a few years ago to what’s happening in 2025, it’s pretty clear that audit and accounting services don’t operate the same way anymore. The shift wasn’t sudden, but the traditional, slow methods just couldn’t keep up with what businesses need today. With new tools coming in, companies working across […]

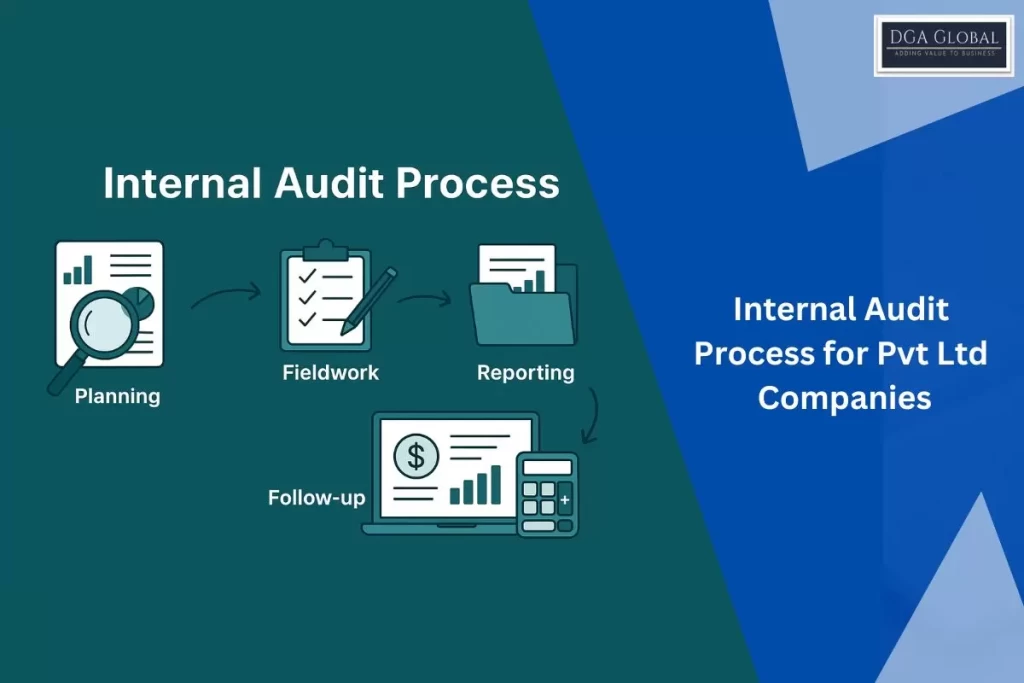

Internal Audit Process for Pvt Ltd Companies

In today’s fast-changing business environment, offshore audit services have become an essential partner for private limited companies seeking financial accuracy, compliance, and operational transparency. An internal audit is no longer just about checking numbers—it’s a strategic process that helps businesses strengthen their foundations and prevent potential risks before they occur. What is an Internal Audit? […]

Top Challenges in Auditing Services Faced by Businesses in the UK & US

Auditing services are essential for ensuring financial transparency, compliance, and investor trust across the UK, US, and other developed markets. Yet, many organizations struggle with unique challenges that make audits more demanding than ever. From stricter regulations to global competition and talent shortages, businesses are rethinking how audits fit into their growth strategies. In this […]

How Audit Tax Advisory Services Are Reshaping U.S. Strategy in 2025

In 2025, auditing services are no longer just a regulatory necessity they’re a strategic asset. From mid-sized firms to billion-dollar corporations, businesses across the U.S. are rethinking their financial strategies with the help of specialized audit tax advisory services. These services are acting as a bridge between compliance and competitiveness in a volatile global market. […]

How Auditing Services Simplify Financial Workflows Across the UK, US & Canada

Auditing services are no longer just about compliance. Today, they have become a powerful tool for simplifying and streamlining financial workflows for companies operating in dynamic markets like the UK, US, and Canada. With changing regulatory demands and global expansion, businesses now require strategic auditing to improve internal controls, reduce risks, and ensure smooth financial […]

Why Audit Tax Advisory Services Will Define the Next Business Decade

No matter where your business is located — New York, London, Singapore, or Sydney — navigating financial decisions is no longer just about keeping the books clean. It’s about planning smartly, staying compliant, and adapting quickly. That’s why audit tax advisory services are moving from being just a back-office function to a front-line strategy for […]

How Technology is Transforming the Audit of Alternative Investments in India

These days, the way audits are done is changing fast. Especially when it comes to alternative investments like hedge funds, private equity, or real estate, the traditional audit approach just doesn’t cut it anymore. Audit tax advisory services are evolving to meet these new demands. As these complex investments keep growing around the world, auditors […]

7 Benefits of Offshore Audit Support Services for CPA Firms

In today’s fast-paced financial world, audit and accounting services are the backbone of transparency and compliance. As CPA firms across the globe strive to deliver accurate, timely, and high-quality audit outcomes, offshore audit support services are becoming a game-changer. Whether you’re a growing CPA firm in the US, UK, Australia, or anywhere in the world, […]

Understanding Alternative Investment Audits in India: A Complete Guide

Alternative investments in India—ranging from hedge funds and private equity to real estate and commodities—have surged in popularity. With this rise comes the need for robust audit and accounting services to ensure regulatory compliance, transparency, and investor confidence. In this comprehensive guide, we’ll walk you through the fundamentals of alternative investment audits, why they matter, […]