Auditing services play a far deeper role in business success than most companies realize. While audits are often viewed as a compliance requirement, their real value lies in how they strengthen tax accuracy, reduce financial risks, and improve long-term decision-making. For businesses operating in complex tax environments like the US and UK, a well-structured audit can be the difference between smooth compliance and costly penalties.

This blog explores the hidden yet powerful connection between audits and tax accuracy explaining why businesses that invest in professional audits experience fewer tax disputes, better reporting clarity, and stronger financial credibility.

The Real ROI of Professional Auditing Services for US, UK Businesses

Audits are often seen as an expense, but in reality, they deliver measurable financial returns especially in tax accuracy and compliance.

Professional auditing services offer clear ROI for US and UK businesses by improving tax accuracy and reducing compliance risks. They help identify errors early, avoid penalties, and ensure financial records meet regulatory standards. This leads to smoother audits, stronger stakeholder trust, and long-term cost savings.

How audits create real value:

- Identify underreported or overreported tax liabilities

- Detect errors in revenue recognition and expense classification

- Ensure alignment with local tax laws and international standards

- Reduce the risk of penalties, interest, and reassessments

Simple ROI Breakdown

| Audit Impact Area | Without Audit | With Professional Audit |

| Tax filing accuracy | Medium | High |

| Risk of penalties | High | Low |

| Financial credibility | Moderate | Strong |

| Investor & lender trust | Limited | Improved |

Key Insight: Businesses that undergo regular audits experience fewer tax notices and smoother regulatory interactions saving both time and money.

How Audits Improve Tax Accuracy at the Transaction Level

Tax errors rarely occur due to intention they usually stem from small transactional mistakes that compound over time. Audits focus on these micro-level details.

What auditors typically review:

- Revenue recognition timing

- Expense categorization

- GST/VAT applicability

- Inter-company transactions

- Payroll and statutory deductions

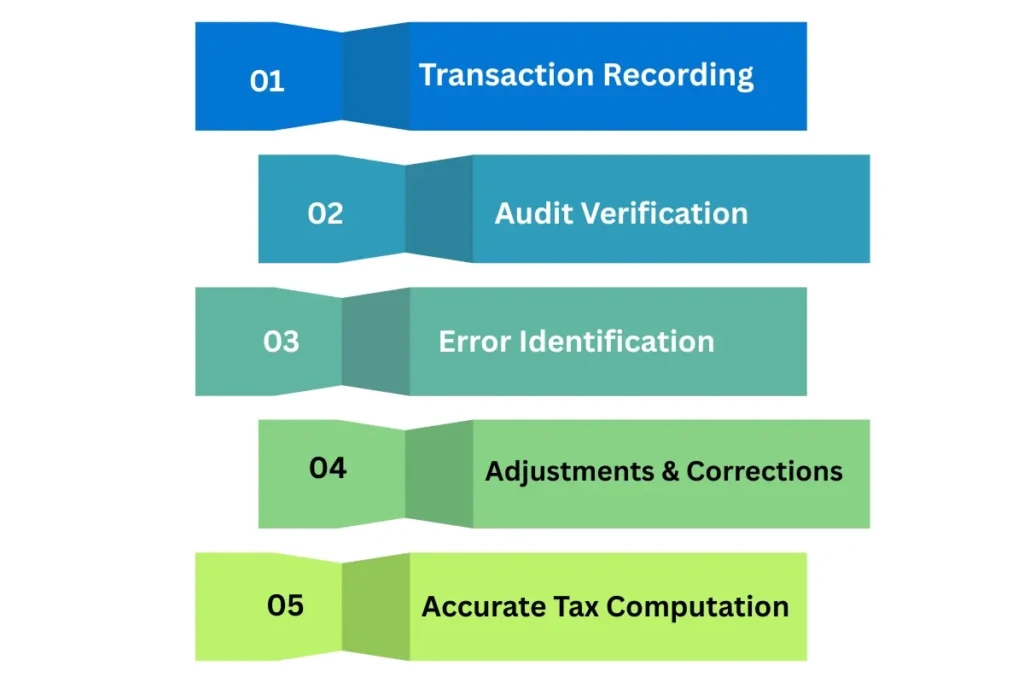

Audit to Accurate Tax Filing

By validating every financial transaction, audits ensure that tax calculations are based on clean, verified data eliminating guesswork and assumptions.

The Overlooked Role of Audit and Accounting Alignment

One of the biggest causes of tax discrepancies is misalignment between bookkeeping and compliance reporting. When financial records are inconsistent, tax filings automatically suffer leading to corrections, penalties, and loss of credibility.

Why integrated audit and accounting services matter:

- Ensure financial books match statutory and tax filings

- Prevent last-minute tax adjustments and rework

- Improve documentation quality for assessments and audits

- Create a single, reliable source of financial truth

How Audit Accounting Alignment Improves Tax Accuracy

| Area of Alignment | Without Audit Integration | With Audit–Accounting Alignment |

| Financial data consistency | Mismatched records | Fully reconciled books |

| Tax computation accuracy | High risk of errors | Accurate and compliant filings |

| Documentation quality | Incomplete or scattered | Structured and audit-ready |

| Regulatory preparedness | Reactive corrections | Proactive compliance |

| Assessment response time | Delayed and uncertain | Faster and well-supported |

Can Audits Actually Prevent Tax Errors Before They Happen?

Most businesses treat tax accuracy as a year-end activity. But in reality, tax errors usually originate months earlier during day-to-day financial recording. This is where audits—supported by audit tax advisory services play a proactive role rather than a corrective one.

Here’s how audits help prevent tax errors proactively:

- Early detection of misclassifications that could impact tax liability

- Verification of tax-sensitive transactions such as related-party dealings

- Cross-checking compliance assumptions against actual financial records

- Consistency checks across accounting periods to avoid reporting gaps

When audits are embedded into the financial cycle, tax filings become a result of verified data not assumptions or last-minute adjustments.

Why this matters: Businesses that adopt audit-led reviews experience fewer tax notices, smoother assessments, and greater confidence during regulatory scrutiny. Instead of reacting to tax issues, they prevent them altogether.

Yes, audits can prevent tax errors before they happen by identifying inconsistencies in financial records, transaction classifications, and compliance assumptions early in the process. By reviewing data throughout the accounting cycle, audits ensure tax calculations are based on verified and accurate information. This proactive approach minimizes last-minute corrections, penalties, and compliance risks.

Building Trust Through Audit-Driven Tax Transparency

Tax authorities, investors, and stakeholders trust businesses that present transparent, audit-backed financial data.

Benefits of audit-driven transparency:

- Faster tax assessments

- Reduced follow-up queries

- Stronger defense during tax audits

- Improved reputation with regulators

| Stakeholder | Audit Impact on Trust |

| Tax Authorities | High confidence |

| Investors | Improved credibility |

| Banks & Lenders | Lower risk perception |

| Business Partners | Stronger reliability |

Transparency is no longer optional it is a competitive advantage in today’s regulatory environment.

Conclusion: Why Businesses Can’t Ignore the Audit–Tax Connection

Accurate tax filing doesn’t begin at tax season it starts with strong financial controls and reliable audits. Businesses that rely solely on tax filing without audit support often face avoidable risks, corrections, and penalties.

By leveraging professional audits, companies gain:

- Clean and compliant financial data

- Fewer tax disputes

- Better advisory insights

- Long-term financial confidence

For global businesses seeking accuracy, compliance, and scalability, offshore audit services provide the expertise and structured approach needed to meet evolving tax regulations with confidence.

FAQs

Q1. What is the difference between audit and tax audit?

An audit reviews a company’s financial statements to ensure accuracy and compliance with accounting standards. A tax audit specifically examines tax filings to verify whether taxes have been calculated and paid correctly. In short, an audit checks overall financial health, while a tax audit focuses only on tax compliance.

Q2. How does auditing help in ensuring the accuracy of financial information?

Auditing helps ensure financial accuracy by reviewing transactions, confirming records, and identifying errors or inconsistencies. It verifies that financial statements are prepared according to applicable standards and regulations. This process builds reliability and confidence in the reported financial information.

Q3. What is the relationship between auditing and taxation?

Auditing and taxation are closely connected because audits verify the financial data used for tax calculations. Accurate, audited records reduce errors in tax filings and lower the risk of disputes with tax authorities. Together, they ensure compliance, transparency, and reliable financial reporting.