Alternative investments in India—ranging from hedge funds and private equity to real estate and commodities—have surged in popularity. With this rise comes the need for robust audit and accounting services to ensure regulatory compliance, transparency, and investor confidence.

In this comprehensive guide, we’ll walk you through the fundamentals of alternative investment audits, why they matter, and how leading audit firm services and tax advisory firms in India are redefining this crucial financial process.

What Are Alternative Investments?

Alternative investments are financial assets that fall outside conventional categories like stocks, bonds, or cash. They include:

1. Private Equity

Private equity involves investing directly in private companies or buying out public companies to delist them from stock exchanges. The goal is to restructure and grow these companies, then sell them at a profit. These are long-term investments, often requiring a holding period of 5–10 years.

2. Venture Capital

A subset of private equity, venture capital focuses on early-stage startups with high growth potential. Venture capitalists provide not only funding but also mentorship and strategic guidance in exchange for equity in the company. Though risky, the rewards can be massive if the startup becomes successful.

3. Hedge Funds

Hedge funds are pooled investment funds that use sophisticated strategies like short selling, derivatives trading, arbitrage, and leverage to generate returns. These funds aim for absolute returns, whether the market is up or down. Due to their complexity, they are usually accessible only to accredited investors.

4. Real Estate

Investments in commercial or residential real estate properties offer rental income and capital appreciation. Real estate can serve as a hedge against inflation and adds tangible value to a portfolio. It also includes REITs (Real Estate Investment Trusts), which are more liquid options.

5. Infrastructure

Investing in infrastructure projects like roads, bridges, airports, or energy grids is a growing trend in India. These are capital-intensive but provide stable, long-term cash flows, often backed by government contracts or public-private partnerships.

6. Commodities

These include physical assets like gold, silver, oil, agricultural products, and more. Commodities are often used as a safe haven during times of market volatility or inflation. Investment is done through futures contracts, ETFs, or direct ownership.

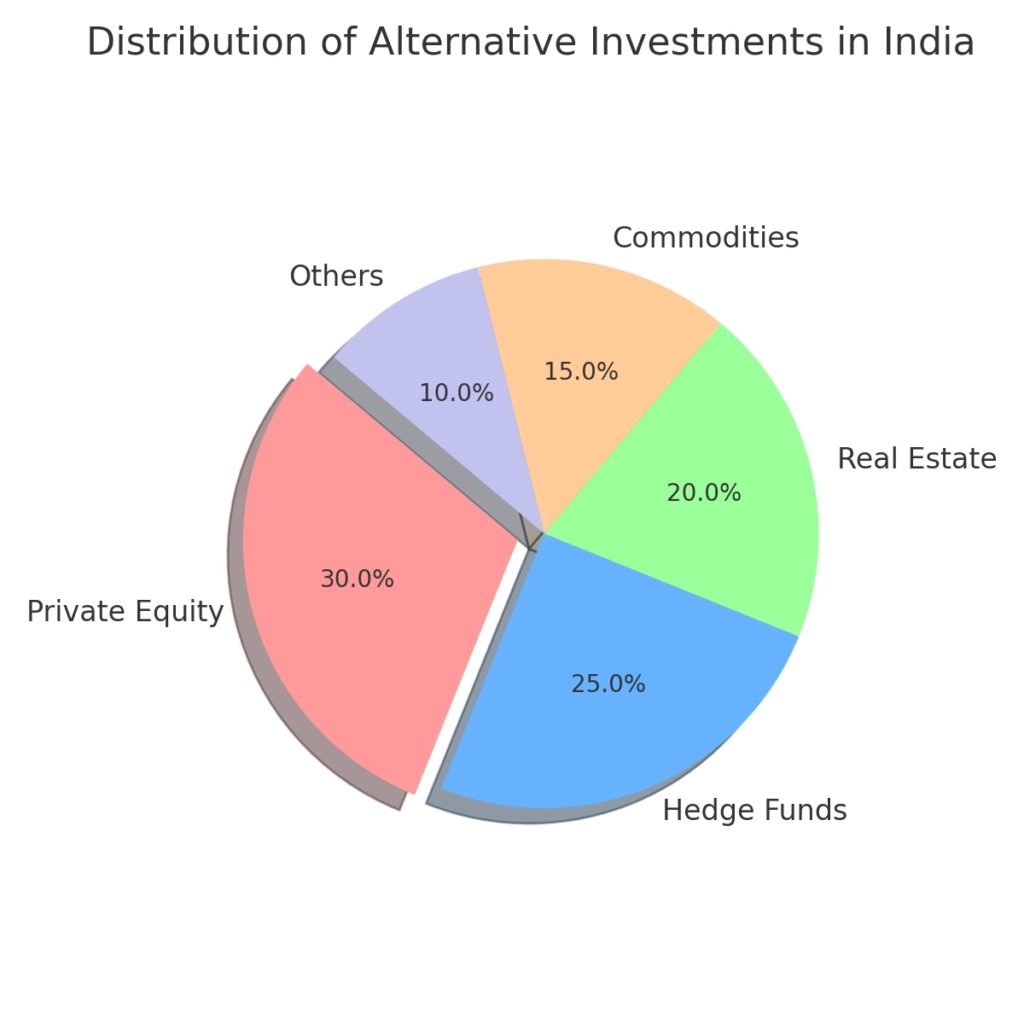

The Investment Landscape in India

As per recent reports, India’s alternative investment market is expanding rapidly. Here’s a look at the distribution:

This boom necessitates detailed audits to maintain credibility and attract foreign as well as domestic investors.

Why Are Audits Crucial for Alternative Investments?

Audits ensure:

- Compliance with SEBI (Securities and Exchange Board of India) regulations

- Transparent reporting for investors

- Detection of fraud and financial discrepancies

- Reliable valuation of assets

A well-structured audit not only secures the firm’s reputation but also boosts investor trust. That’s why experienced audit firm services are in high demand.

Key Focus Areas in Alternative Investment Audits

- Valuation Practices

Valuing illiquid assets like real estate or start-ups is tricky. Auditors scrutinize these with bespoke valuation models. - Regulatory Compliance

SEBI norms and AIF (Alternative Investment Fund) regulations must be met. - Fee Structures and Distributions

Auditors examine how management fees and performance bonuses are calculated and distributed. - Financial Reporting and Disclosure

Accuracy, transparency, and timely reporting are key to building investor confidence.

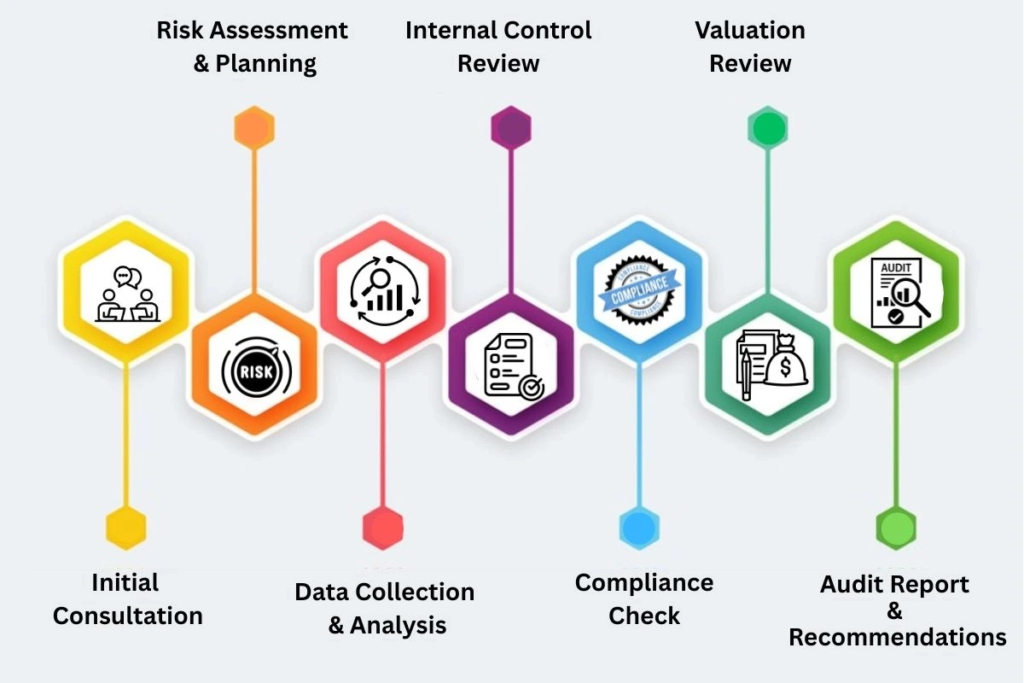

How the Audit Process Works

Final Thoughts

As alternative investments continue to diversify portfolios and attract HNIs, the need for thorough, reliable, and expert audits is more critical than ever. Whether you’re an investor, fund manager, or compliance officer, understanding how audit tax advisory services operate gives you a strategic edge.

FAQs

- Who regulates alternative investment funds in India?

The Securities and Exchange Board of India (SEBI) regulates Alternative Investment Funds (AIFs) under the SEBI (Alternative Investment Funds) Regulations, 2012. - How many AIFs are there in India?

As of 2024, there are over 1,200 registered AIFs in India, with the number growing rapidly due to increased interest from both domestic and international investors.