Accounting financial advisory is a cornerstone for any growing business. It helps companies manage complex financial operations, make informed decisions, and ensure compliance with regulatory standards. But how do you know when it’s the right time to upgrade your services? This guide will help you identify key indicators and make the transition smoothly.

Is Your Business Growing Too Fast for Your Current Accounting Financial Advisory Services?

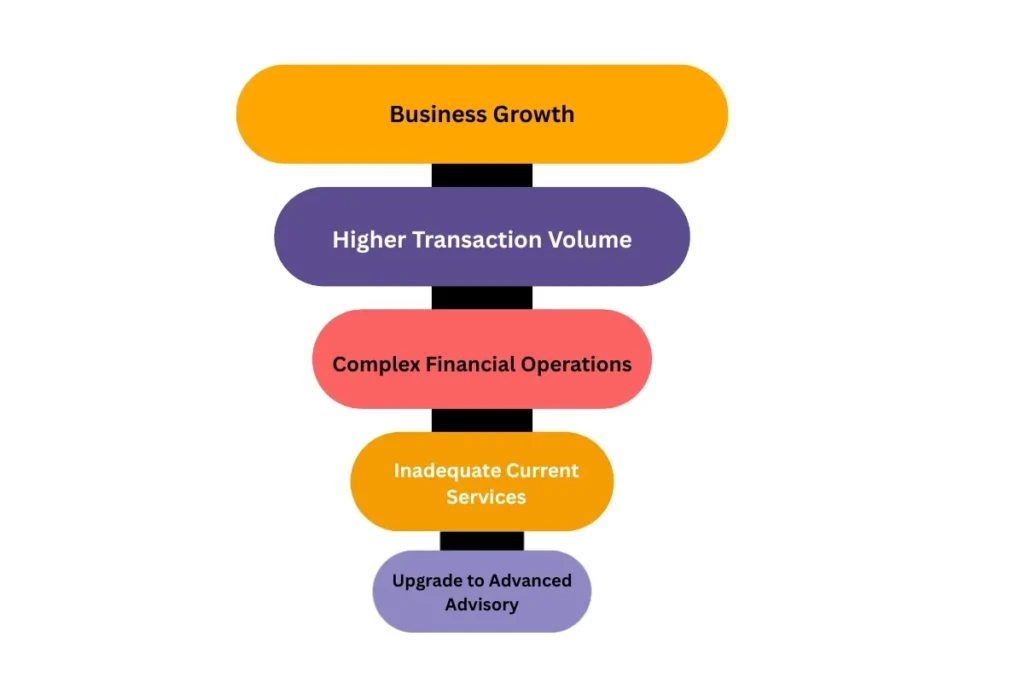

Rapid business growth is exciting but it comes with its own set of financial challenges. As your company expands, transactions multiply, operations become more complex, and basic accounting solutions may no longer be sufficient. Relying on outdated systems or minimal advisory support can lead to errors, delayed reporting, and even compliance issues.

Signs your current accounting services may not be enough:

- Transaction volume is increasing significantly every month

- Multiple revenue streams or business lines make tracking complex

- Expansion into new markets or international operations

Upgrading to advanced accounting financial advisory services ensures that your financial data is accurate, organized, and ready for strategic decision-making. This isn’t just about keeping the books it’s about enabling your business to scale without financial bottlenecks.

When to Upgrade Accounting Financial Advisory Services

By recognizing these early warning signs, you can proactively invest in professional advisory services to support sustained growth and prevent costly mistakes.

Need for Strategic Client Advisory Services

As businesses grow, the need for client advisory services increases. Upgraded advisory services go beyond bookkeeping, offering insights into cash flow management, financial forecasting, and risk management.

Benefits of upgraded client advisory services:

- Better budgeting and forecasting

- Improved decision-making for investments

- Proactive risk management

Comparison Between Basic Accounting vs. Advanced Advisory

| Feature | Basic Accounting | Upgraded Advisory Services |

| Transaction Tracking | ✅ | ✅ |

| Financial Forecasting | ❌ | ✅ |

| Risk Analysis | ❌ | ✅ |

| Strategic Insights | ❌ | ✅ |

Investing in advanced advisory ensures that your financial strategies align with your business goals.

How Do Compliance and Regulatory Requirements Impact Your Business?

Businesses must follow strict legal, tax, and financial regulations. As your operations grow, outdated accounting systems or basic advisory support may struggle to keep up with changing compliance standards. Upgrading ensures your business aligns with the latest audit and accounting services requirements—reducing risks and strengthening trust with stakeholders.

Key Compliance Triggers to Look Out For

These situations often signal that your current accounting setup is no longer enough:

- Expansion into new domestic or international markets

- Frequent changes in tax laws or filing requirements

- Increased audits, financial reviews, or scrutiny from authorities

What Happens If You Don’t Stay Compliant?

Ignoring compliance updates can lead to issues that impact both your finances and reputation:

- Penalties & Fines: Even small errors or late filings can be expensive.

- Operational Delays: Incorrect or missing documents slow down approvals.

- Damaged Credibility: Non-compliance makes lenders, partners, and investors hesitant.

Why Upgrading Your Advisory Services Solves Compliance Issues

Modern accounting financial advisory services offer:

- Real-time updates on regulations

- Automated compliance checks

- Error-free tax and audit preparation

- Strong internal controls for secure reporting

Upgrading ensures your business avoids penalties and maintains credibility with stakeholders while staying confidently ahead of regulatory changes.

Preparing for Future Expansion

If your business plans to scale, merge, or attract investors, upgrading accounting and advisory services is critical. Advanced services provide clear financial visibility and confidence for stakeholders.

Key Focus Areas for Expansion:

- Streamlined reporting for investors

- Robust internal controls

- Financial planning for mergers and acquisitions

Readiness Checklist for Business Expansion

| Area | Status | Upgrade Needed? |

| Financial Reports | Basic | Yes |

| Risk Management | Moderate | Yes |

| Investor-ready Documents | Limited | Yes |

| Forecasting & Planning | Basic | Yes |

Preparing your finances with advanced advisory services ensures smoother transitions during critical growth phases.

Conclusion

Upgrading to comprehensive accounting financial advisory services helps businesses stay compliant, improve financial accuracy, and make smarter decisions as they grow. With better audit processes, stronger advisory support, and modern technology, companies can manage their finances with greater confidence.

For smaller companies, choosing reliable accounting services for a small business is a smart step toward long-term stability and smoother financial management.

FAQs

Q1. What are financial advisory services in accounting?

Financial advisory services in accounting help businesses make better financial decisions by providing expert guidance on budgeting, forecasting, compliance, risk management, and overall financial planning.

Q2. What type of accounting is most in demand?

Management accounting and financial accounting are the most in-demand types, as businesses rely on them for budgeting, decision-making, financial reporting, and compliance.

Q3. What to know before talking to a financial advisor?

Before talking to a financial advisor, know your financial goals, current income and expenses, existing investments or debts, and the specific guidance you’re looking for.