Bookkeeping and tax service is more than just recording transactions—it’s a crucial part of running a successful business. Timely bookkeeping ensures accurate financial tracking, smooth tax filing, and actionable insights for informed decision-making. Many small business owners underestimate its importance, but staying up-to-date with financial records can save money, prevent errors, and guide growth strategies.

Understanding the True Value of Timely Bookkeeping

Bookkeeping isn’t just an administrative task—it’s the backbone of financial clarity. Timely bookkeeping allows businesses to:

- Gain Accurate Insights: Know exactly where your money is going and coming from.

- Detect Errors Early: Spot discrepancies or unpaid invoices before they escalate.

- Reduce Stress: Avoid last-minute tax-season chaos with organized records.

Studies show that businesses maintaining regular bookkeeping are 60% more likely to catch financial issues early, preventing costly mistakes.

Timely bookkeeping provides clear insights into your business finances, helping track income and expenses accurately. It allows you to detect errors early and avoid costly issues. Keeping records up-to-date also reduces stress during tax season.

Compliance and Legal Safeguards

Maintaining timely books keeps you compliant with tax laws and regulatory authorities. Falling behind can lead to fines, audits, and damage to your reputation.

Key Compliance Points:

- Keep invoices, receipts, and payments updated.

- Update financial records weekly to avoid backlog.

- File taxes accurately and on time.

Impact of Late Bookkeeping on Businesses

| Consequence | Potential Cost / Risk |

| Missed Tax Deadlines | Up to 5% penalty per month |

| Cash Flow Mismanagement | Business operational risk |

| Legal Non-Compliance | Fines & lawsuits |

| Financial Misreporting | Reduced investor trust |

Timely bookkeeping protects your business legally and ensures trust with stakeholders.

Optimizing Cash Flow and Business Decisions

Up-to-date financial records allow small businesses to plan budgets and manage cash flow effectively. With timely bookkeeping, owners can:

- Predict peak expenditure periods.

- Avoid overdraft fees or interest charges.

- Plan for growth and investments with accurate data.

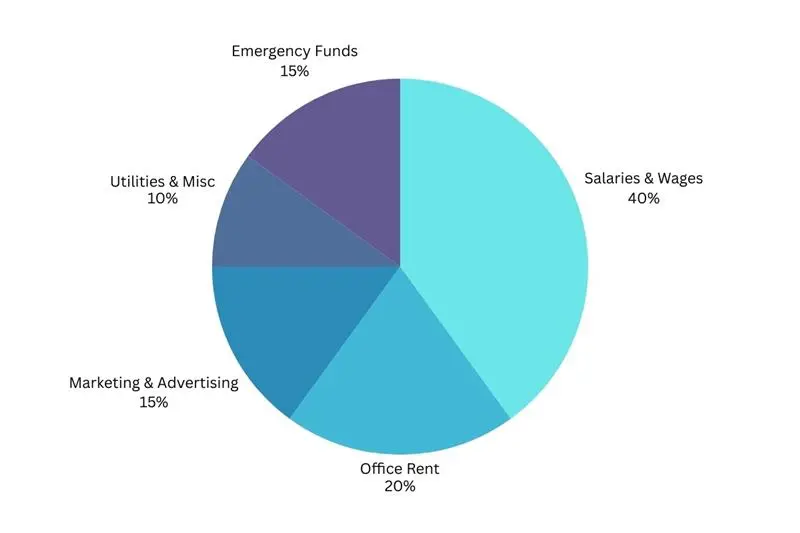

Monthly Expense Breakdown for Small Businesses

Accurate bookkeeping enables businesses to spot opportunities for cost-saving and informed decision-making.

Timely bookkeeping helps you manage cash flow effectively by tracking inflows and outflows accurately. It enables smarter business decisions, like budgeting and planning for investments. With clear financial data, you can avoid surprises and ensure steady growth.

Leveraging Global Outsourcing Services

For many small businesses, managing bookkeeping in-house can be overwhelming. This is where global outsourcing services come into play. By outsourcing your bookkeeping and tax operations, you gain expertise, efficiency, and scalability.

Benefits of Outsourcing:

- Expertise: Professionals handle complex transactions and compliance.

- Cost Efficiency: No need to hire full-time accountants.

- Scalability: Services grow with your business needs.

Outsourced Bookkeeping Process

| Step | Description |

| Client Provides Financial Data | Share all transaction records, invoices, and receipts |

| Outsourced Accounting Team | Professional team processes and manages your books |

| Bookkeeping & Tax Service | Accurate recording, reconciliation, and tax preparation |

| Reports & Insights Delivered | Timely reports and actionable financial insights |

Outsourcing ensures accuracy, saves time, and allows small businesses to focus on core operations.

Supporting Growth with Accounting for Small Business

Timely bookkeeping is essential for sustainable growth. Accurate financial records allow business owners to:

- Identify profitable products and services.

- Reduce unnecessary expenses.

- Secure loans or attract investors with trustworthy statements.

Checklist for Small Business Bookkeeping:

- Record daily transactions.

- Reconcile bank statements weekly.

- Track accounts receivable and payable.

- Review monthly financial reports.

Implementing these practices helps accounting for small business become more streamlined, creating a strong foundation for long-term success.

Accurate and timely bookkeeping helps small businesses identify profitable areas, reduce unnecessary expenses, and plan for expansion. It ensures reliable financial records that support informed decisions and attract investors. Strong accounting practices lay the foundation for sustainable growth.

Conclusion

Timely bookkeeping is not just a routine task—it’s a vital part of running a successful and sustainable business. From ensuring compliance and managing cash flow to enabling informed decision-making, the benefits of staying on top of your financial records are undeniable. Small businesses that adopt organized bookkeeping practices can save time, reduce costs, and make smarter growth decisions.

For businesses looking to maintain accuracy, efficiency, and clarity in their finances, professional accounting services for a small business are the key to building a strong financial foundation and achieving long-term success.

FAQ

Q1. What is the significance of timely and accurate bookkeeping?

Timely and accurate bookkeeping ensures clear financial visibility, helps in informed decision-making, prevents errors, and keeps your business compliant with tax and legal requirements.

Q2. Why is proper bookkeeping important?

Proper bookkeeping is important because it maintains accurate financial records, ensures compliance, improves cash flow management, and supports informed business decisions.

Q3. Why is it important to prepare accurate and timely financial statements?

Accurate and timely financial statements are important because they provide a clear picture of a business’s financial health, support informed decisions, and ensure compliance with regulatory requirements.